Introduction

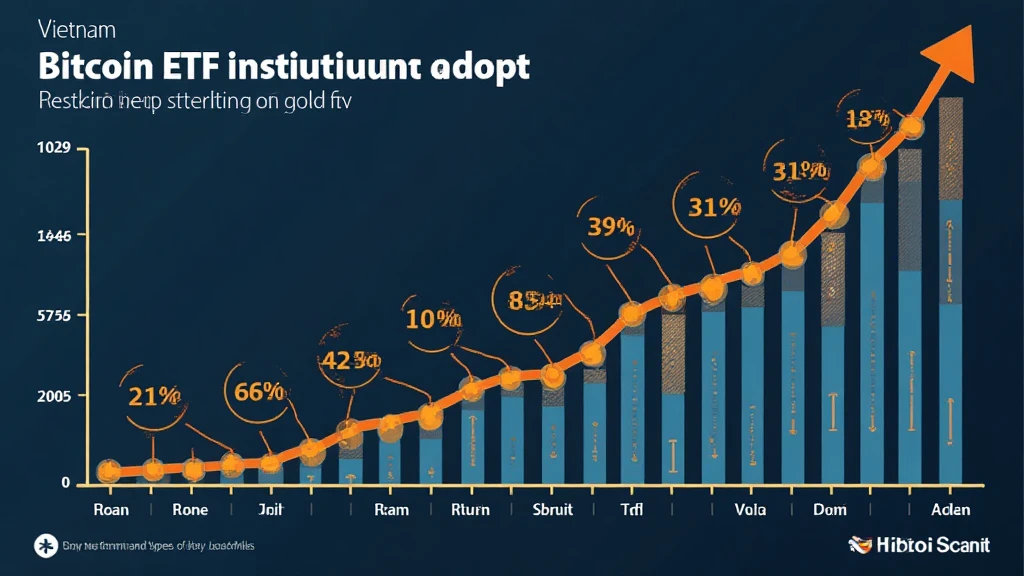

With an impressive 22% growth rate in cryptocurrency adoption among Vietnamese users in 2023, the country’s financial landscape is undergoing remarkable changes. The introduction of a Bitcoin ETF in Vietnam signifies a new dawn for institutional investors, raising questions about its potential impact on the overall adoption of cryptocurrencies. Are you ready to discover how this trend could reshape the future of digital assets in Vietnam?

Understanding Bitcoin ETFs

Bitcoin ETFs (Exchange Traded Funds) allow investors to buy into Bitcoin without having to own the underlying asset directly. Instead, they purchase shares of the ETF that holds Bitcoin as part of its asset portfolio. This is a significant step towards institutional adoption in the cryptocurrency market.

Just like investing in a mutual fund that diversifies across various stocks, a Bitcoin ETF gives investors exposure to Bitcoin while offering it a more regulated, traditional investment framework. The convenience of this product is expected to attract Vietnamese institutional investors, unlocking more significant capital flow into the crypto space.

Vietnam’s Cryptocurrency Market Landscape

The cryptocurrency market in Vietnam has seen thrilling transformations over the years. According to reports, the number of crypto users in Vietnam reached approximately 5 million in 2023, signaling a rise in the popularity of digital assets.

- Regulatory Framework: The Vietnamese government is actively working towards a regulatory framework for cryptocurrencies, which includes the potential approval of Bitcoin ETFs. This is a crucial step in fostering institutional investment.

- Growing Interest: Local interest in cryptocurrencies has surged, fueled by opportunities to invest and trade in an increasingly volatile market, attracting both retail and institutional investors.

The Role of Bitcoin ETFs in Institutional Adoption

One of the primary reasons behind the interest in Bitcoin ETFs is their accessibility. Institutional investors are generally more comfortable with regulated investment vehicles, which Bitcoin ETFs provide. This can lead to a broader acceptance of cryptocurrencies as a legitimate asset class.

Just like the way traditional financial instruments pulled large funds into the stock market, the Bitcoin ETF is likely to function similarly for the crypto market in Vietnam:

- Increased Media Coverage: More media attention is expected with the acceptance of Bitcoin ETFs. This could drive consumer interest and education regarding cryptocurrencies.

- Liquidity Enhancement: As more institutional investors enter the ecosystem, trading liquidity is expected to improve, benefiting all market participants.

Current Challenges and Risk Factors

While the prospects of Bitcoin ETFs in Vietnam are bright, challenges remain:

- Regulatory Hurdles: The regulatory landscape is still evolving. Clear guidelines must be established to ensure investor protection and market integrity.

- Market Volatility: Cryptocurrencies are known for their price volatility, which poses risks for institutional investors who typically prefer stable investment options.

Comparative Analysis: Global Scenario

Countries like the USA and Canada have set examples with their Bitcoin ETF approvals. For instance, in Canada, the approval of Bitcoin ETFs in 2021 resulted in significant inflows of investment into the crypto sector, rapidly boosting adoption rates.

Considering the 20% of institutional investors in developed economies that already allocate funds to cryptocurrencies, Vietnam, with its escalating adoption rates, stands to benefit immensely from a similar trend.

Prospects for Vietnam’s Institutional Adoption Rate

The various factors contributing to the likelihood of increased institutional adoption of Bitcoin ETFs in Vietnam include:

- Education Initiatives: Increasing educational initiatives about cryptocurrency investments can build investor confidence, enabling more institutional players to enter the market.

- Blockchain Security Standards (tiêu chuẩn an ninh blockchain): As the Vietnamese authorities work towards higher security standards, trust in digital asset custody solutions enhances, thereby increasing institutional interest.

Conclusion

Vietnam’s Bitcoin ETF institutional adoption rate is at a crucial juncture. As the regulatory framework evolves and institutional interest strengthens, cryptocurrencies could find a firm foothold in the financial ecosystem. The potential for Bitcoin ETFs to catalyze deeper engagement from institutional players can’t be overstated. In Vietnam, the future seems bright for both cryptocurrencies and institutional adoption, making it an exciting time for the nation’s financial landscape.

As we look ahead, understanding the trends and regulations surrounding Vietnam’s Bitcoin ETF institutional adoption rate will be key for investors and stakeholders alike. We invite you to stay informed by exploring resources on官方加密货币新闻—officialcryptonews.