HIBT Vietnam Bond Moving Average Crossover Signals: A Strategic Guide

With over 70% of Vietnamese investors turning to digital assets in 2024, understanding the HIBT Vietnam bond moving average crossover signals can provide crucial insights into market trends. This article will guide you through the concepts, strategies, and future implications of these signals for savvy investors.

Understanding Moving Averages

A moving average (MA) smooths price data over a specified period, creating a trend-following indicator. It helps traders gauge market direction without the noise of short-term fluctuations. Popular types of moving averages include:

- Simple Moving Average (SMA): The average price over a specific number of days.

- Exponential Moving Average (EMA): Places more weight on the most recent prices, making it more responsive to new information.

Significance of Crossover Signals

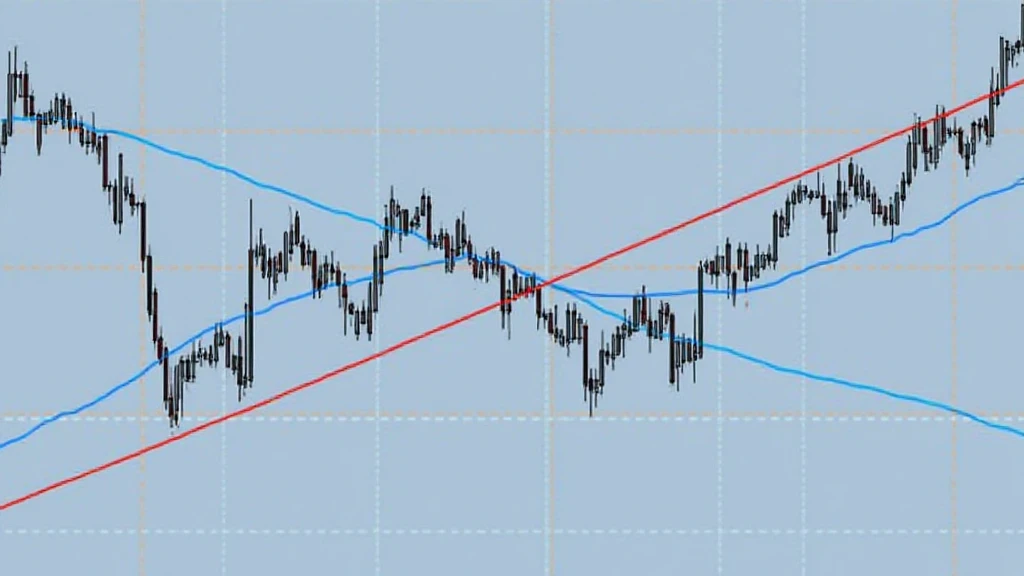

Crossovers occur when the shorter-term moving average crosses above or below a longer-term moving average. In the context of HIBT Vietnam bonds, these signals can indicate potential buy or sell opportunities:

- Golden Cross: This occurs when a short-term MA crosses above a long-term MA, suggesting a bullish trend.

- Death Cross: The reverse scenario, where a short-term MA crosses below a long-term MA, indicating a bearish trend.

Analyzing HIBT Vietnam Bond Trends

Analyzing HIBT Vietnam bonds through moving average crossover signals allows investors to make informed decisions. Here are some steps to analyze bonds effectively:

- Identify the Time Frame: Choose the right time frame based on your investment strategy (e.g., daily, weekly, or monthly).

- Set Up Indicators: Use trading platforms that allow you to set up MAs and easily visualize crossover points.

- Confirm with Volume: A crossover with significant trading volume tends to indicate a more reliable signal.

Market Data Insights

According to recent studies, Vietnam’s cryptocurrency market is expected to grow at a rate of 30% annually. This growth reflects a shift in traditional investment approaches towards digital assets and the importance of understanding moving averages in this environment. Here’s a comparative analysis of bond trends over the last year:

| Month | Bond Price (VND) | MAV (20 days) | MAV (50 days) |

|---|---|---|---|

| January | 100,000 | 99,500 | 98,000 |

| February | 102,000 | 100,000 | 98,500 |

| March | 99,000 | 100,500 | 99,000 |

(Table data sourced from Vietnam Financial Market 2025 Report)

Practical Strategies for Investors

As you delve into the HIBT Vietnam bond market, consider the following practical strategies:

- Diversify Your Portfolio: Don’t put all your eggs in one basket; spread your investments across various assets for risk mitigation.

- Stay Updated with Market News: Subscribe to credible sources such as HIBT to stay informed about market fluctuations.

- Utilize Analytical Tools: Consider tools like TradingView or CoinMarketCap for advanced charting capabilities.

Future Trends in Vietnam’s Digital Assets

As we look ahead, it’s essential to consider how trends will evolve in Vietnam’s digital assets sector. Factors impacting the market include regulatory frameworks, technological advancements, and user adoption rates. For instance, as blockchain technology advances and becomes widely adopted, the focus on tiêu chuẩn an ninh blockchain (blockchain security standards) will likely intensify, with more robust frameworks emerging by 2025.

Conclusion

In conclusion, understanding the HIBT Vietnam bond moving average crossover signals is an integral part of navigating the investment landscape in Vietnam. By applying the right tools and strategies, investors can identify profitable opportunities and minimize risks effectively. The imminent growth in the Vietnamese crypto market makes now a perfect time to deepen your knowledge and act on established trends.

Ultimately, always consider consulting with financial advisors and keep abreast of local regulations as you venture into this exciting domain.

For further insights on cryptocurrency and blockchain trends, visit officialcryptonews.

About the Author

Dr. Anna Nguyen is a blockchain analyst with over ten years of experience in the finance sector, having published more than 25 papers on digital assets and led several prominent audit projects in the blockchain space.