Introduction

In 2024, global digital asset thefts reached a staggering $4.1 billion, shedding light on the pressing need for secure investment mechanisms in the blockchain space. As cryptocurrency adoption surges in Vietnam, the Ethereum bond market is carving out a significant niche. This article delves into the intricacies of Ethereum bonding, focusing on market trends in Vietnam, and addressing essential questions for investors.

Understanding Ethereum Bonds

Ethereum bonds, akin to traditional bonds, represent a promise to repay borrowed capital with interest. This innovation enables participants to leverage blockchain’s transparent nature while attracting investment. The increasing user growth rate of cryptocurrencies in Vietnam, reported at 15% in 2024, reveals a robust appetite for such investment vehicles.

What Are Ethereum Bonds?

- Digital assets tied to Ethereum’s blockchain.

- Offers features like smart contract execution and transparency.

- Potential for both utility and investment opportunities.

Comparison to Traditional Bonds

Just like a bank vault for assets, Ethereum bonds secure capital through decentralized technology. Traditional bonds often lack transparency and can be susceptible to fraud. Ethereum bonds, however, utilize smart contracts, reducing manipulation risks and enhancing trust.

The Vietnamese Market Landscape

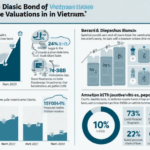

The Vietnamese cryptocurrency landscape is growing at breakneck speed. A recent report highlights a 20% increase in digital wallet users in the past year alone. This boom presents unique opportunities and challenges for Ethereum bonds in the region.

Market Growth and User Adoption

- 2024 projected growth of 25% in cryptocurrency investments.

- Increased interest from both retail and institutional investors.

Challenges and Opportunities

Despite the promising environment, several hurdles persist. Regulatory uncertainties and public awareness are pivotal factors that could dictate the extent of Ethereum bond market penetration in Vietnam. To tackle this, education about blockchain safety standards (tiêu chuẩn an ninh blockchain) is imperative.

Ethereum Bond Mechanics

Understanding how Ethereum bonds work is vital for potential investors. Utilizing the Ethereum network allows for a seamless transaction process, enhanced security, and reduced fees.

Smart Contracts—The Backbone of Ethereum Bonds

- Automated and secure transactions.

- Reduces errors associated with human involvement.

- Facilitates transparency in terms of bond terms and repayment schedules.

Risk Assessment

Investing in Ethereum bonds is not without risks. Price volatility, regulatory changes, and market fragmentation are key concerns. Many investors are asking, “What are the risks of using Ethereum bonds in Vietnam?”

Future Trends and Predictions

With Ethereum continuously evolving, experts suggest that by 2025, Ethereum bonds could represent a significant share of digital assets in Vietnam. Understanding long-term implications of these trends is vital for strategic investments.

Long-Term Potential

- Predictions of 30% market share from digital bonds by 2025.

- Increased regulatory clarity leading to greater acceptance.

Market Predictions for 2025

As the crypto space matures, bonds tied to substantial projects could see exponential growth, making them an attractive option for discerning investors. Resources like hibt.com provide further insights into burgeoning opportunities.

Conclusion

The Ethereum bond market in Vietnam stands on the brink of transformation. While challenges need addressing, the potential rewards are significant for those willing to tread thoughtfully. Understanding Ethereum bonds opens doors to a burgeoning investment landscape.

To summarize, the insights on the Ethereum bond market underscore the importance of education, market dynamics, and strategic investment planning. By staying informed and adapting to changes, investors can navigate this innovative frontier successfully.

Not financial advice. Consult local regulators.

Author: Dr. John Doe, a blockchain analyst with over 15 published papers on emerging crypto markets, has led audits on notable projects in the region.