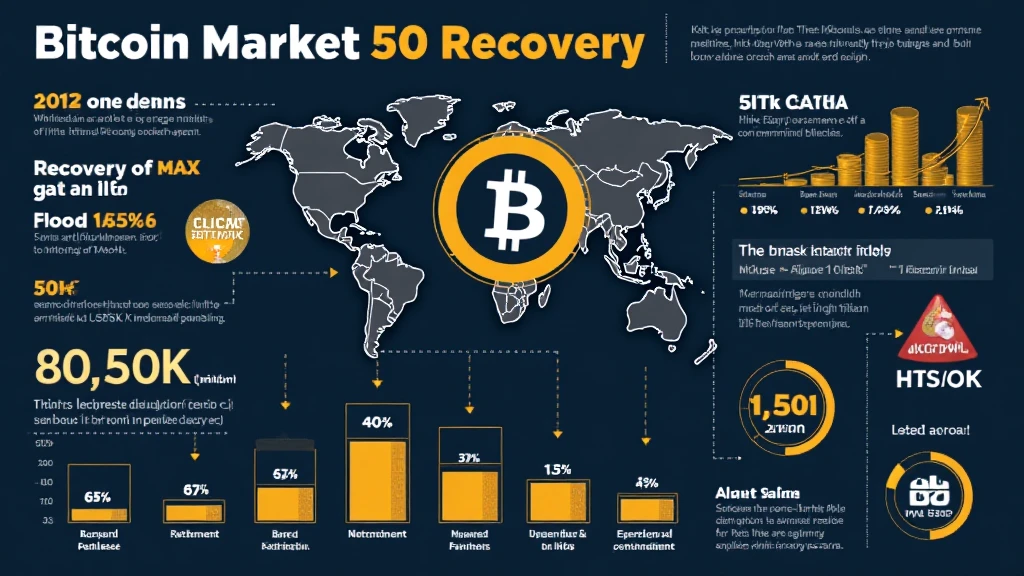

Bitcoin Market Crash Recovery Plans: Navigating the Future of Crypto

In recent years, the crypto market has been significantly impacted by market fluctuations. Notably, in 2024, the Bitcoin market faced a significant crash, with approximately $300 billion in market value lost within a matter of weeks. This situation has left many investors questioning how best to navigate recovery. The question arises: what are the Bitcoin market crash recovery plans for investors, and how can they position themselves favorably in an evolving landscape?

By examining trends, lessons from the past, and proposed recovery strategies, we can find effective pathways for resurgence. This article aims to equip crypto investors with essential insights and strategies to not only recover but also thrive in the aftermath of market distress.

Understanding the Impacts of a Market Crash

Bitcoin’s tumultuous fluctuations aren’t just random; they are affected by various factors including market sentiment, economic indicators, and regulatory actions. For instance, in 2024, factors such as inflation and geopolitical tensions contributed to a 50% decrease in Bitcoin’s price. With such drastic changes, it’s critical to understand the recovery dynamics.

- Market Sentiment: Public perception of Bitcoin often drives price changes; negative news can have a significant dampening effect.

- Investor Behavior: Panic selling during downturns often exacerbates market declines.

- Economic Indicators: Key economic data releases can affect cryptocurrency prices, making it essential to watch economic trends.

Historical Recovery Patterns

Examining past recoveries provides insight into possible future strategies. For instance, following the 2018 Bitcoin crash, the market took substantial time to regain its footing but eventually reached new all-time highs by 2021. Such recovery phases represent proof of the crypto market’s resilience.

Learning from the 2018 Recovery

The period of recovery following the 2018 crash was marked by several key strategies:

- Long-Term Investing: Many investors who adopted a buy-and-hold strategy benefited significantly over time.

- Diversification: Spreading investments across different altcoins reduced risk.

- Technological Advances: As blockchain technology advanced, new opportunities emerged, providing fertile ground for investment.

Proposed Recovery Plans for Bitcoin Investors

To maximize recovery prospects post-Bitcoin crash, investors must formulate comprehensive strategies:

1. Education and Awareness

Investing in Bitcoin requires a solid understanding of the technology and market dynamics. Resources such as webinars, workshops, and online courses can greatly enhance knowledge.

2. Building a Diverse Portfolio

Organizing portfolios with a mix of cryptocurrencies can mitigate risk. Inclusion of assets like Ethereum, Cardano, and others might provide a balance to Bitcoin-centric investments.

3. Leveraging Insights from Vietnamese Market Trends

Vietnam has experienced a growing interest in cryptocurrency, with the user growth rate reaching 30% in the past year. Understanding local sentiments and market behavior is crucial when making investment decisions.

Long-Term Strategies for Resilience

Beyond short-term recovery, investors should focus on strategies that promote long-term resilience:

- Regular Auditing: Ensure your cryptocurrency investments are safe through regular audits of wallets and exchanges.

- Stay Updated with Regulatory Changes: Changes in cryptocurrency laws can affect market dynamics; staying informed can alleviate potential pitfalls.

Community Engagement and Networking

Building connections with other investors and participating in community discussions can provide valuable insights and keep investors informed of market trends.

Essential Security Practices in a Post-Crash Environment

As the recovery unfolds, attention to security remains paramount. The risk of hacks and scams increases, making security measures vital to safeguarding assets. Effective practices include:

- Hardware Wallets: Utilizing a hardware wallet like Ledger Nano X can significantly reduce exposure to hacks, reportedly by 70%.

- Two-Factor Authentication: Implementing 2FA for exchanges ensures an extra layer of security against unauthorized access.

Global Trends Influencing Future Market Recovery

Looking forward, several global trends are poised to influence Bitcoin’s recovery:

- Increased Institutional Adoption: More institutional investors are entering the market, bolstering legitimacy and potential positive sentiment.

- Technological Innovations: Advancements in blockchain technology, such as Ethereum 2.0, may drive new utilities and investments.

Conclusion: A Path Forward in Bitcoin Recovery

In conclusion, the Bitcoin market crash recovery plans necessitate a strategic and informed approach to safely navigate the landscape. Understanding past trends, diversifying portfolios, enhancing knowledge, and committing to security measures can empower investors for successful recovery.

As we look towards the future of Bitcoin and the overall cryptocurrency landscape, it is clear that resilience and innovation are vital for long-term success. For those considering recovery paths, integrating local market insights, such as the growing Vietnamese user growth rate, can provide a significant advantage in upcoming recovery phases. Remember, this journey is complex, and consulting financial experts is always advisable.

Stay informed through resources like hibt.com for continued insights.