Introduction

In 2024, the world witnessed a staggering loss of approximately $4.1 billion due to hacks in decentralized finance (DeFi) platforms. This alarming figure raises critical questions about the adequacy of current cryptocurrency portfolio management strategies. With the rising inconvenience of managing digital assets and ensuring their security, understanding the principles of HIBT crypto portfolio risk management has never been more crucial. This article aims to provide comprehensive insights into managing portfolio risk effectively while emphasizing the importance of securing investments.

Understanding HIBT Principles

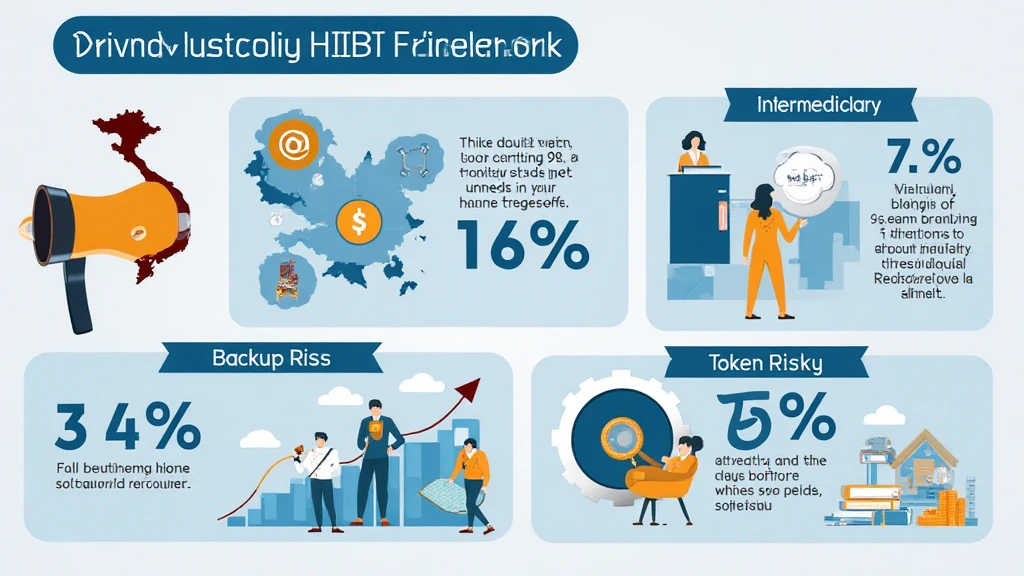

The HIBT framework—standing for Hot, Intermediary, Backup, and Token Risk—emerges as an essential tool in navigating the complexities of crypto portfolio management. Each component addresses specific risks that digital assets face today:

- Hot Wallet Risks: With hot wallets designed for frequent transactions, they are more susceptible to hacks. Implementing additional security layers can mitigate these risks.

- Intermediary Risks: Platforms and exchanges that facilitate transactions pose risks through potential insolvencies or vulnerabilities. Selecting reputable and compliant platforms is essential.

- Backup Risks: Without adequate backups, losing access to wallets can result in irrevocable loss. Regular updates and secure storage solutions for backups are imperative.

- Token Risks: The underlying technology and utility of tokens must be thoroughly researched. Investing in projects with clear use cases minimizes exposure to unreliable tokens.

Statistics on the Vietnam Crypto Market

The cryptocurrency landscape in Vietnam has shown consistent growth, with the user base expanding at an impressive rate of 34% per year. This growth emphasizes the urgent need for effective portfolio risk management practices among Vietnamese crypto investors. Such strategies will not only protect investments but also facilitate informed decision-making in an increasingly volatile market.

Identifying Risk Factors

To develop a robust HIBT crypto portfolio risk management strategy, it is essential to identify various risk factors:

- Market Volatility: The crypto market exhibits significant price fluctuations that can impact portfolio valuations. A diversified portfolio can reduce the impact of such volatility.

- Regulatory Changes: The evolving regulatory landscape in Vietnam poses potential risks. Keeping abreast of changes can prevent unforeseen repercussions.

- Technological Failures: Bugs or failures in smart contracts can result in substantial losses. Regular audits and exploring platforms with robust security protocols can help.

Being proactive in identifying these risks is key to effective risk management, especially in a rapidly evolving market.

Risk Mitigation Strategies

Once risk factors are identified, implementing effective strategies is crucial for HIBT crypto portfolio risk management:

- Diversification: Spread investments across various assets to decrease reliance on any single currency or platform.

- Utilizing Cold Storage: For long-term storage, cold wallets are essential. Hardware wallets like the Ledger Nano X significantly reduce the risk of hacks.

- Regular Audits: Conduct periodic audits of all smart contracts involved. Knowledge about inspecting smart contracts allows for timely detection of vulnerabilities.

- Monitoring Regulations: Staying updated on local regulations, especially in regions like Vietnam, influences investment strategies significantly.

Conclusion

In the landscape of cryptocurrency investments, employing HIBT crypto portfolio risk management strategies is paramount. With substantial financial losses reported, the integration of effective risk mitigation practices holds the key to safeguarding assets. Investing in a diversified portfolio, utilizing security measures like cold storage, and maintaining awareness of regulatory changes strengthen the overall risk management process. As we move towards 2025, the crypto space will continue to evolve, and so too must our strategies to protect our investments. This acknowledgment of ongoing risk and acting upon it will create a resilient investment environment.

Ultimately, adopting HIBT principles not only protects individual assets but also contributes to the overall robustness of the cryptocurrency sector. For continuous updates and insights into risk management in crypto portfolios, visit hibt.com.

This article is not financial advice. Consult with local regulators for compliance specifics.