Introduction

In a dynamic financial environment, understanding market patterns is crucial for success. Did you know that in 2024, the total volume of trading in Vietnamese bonds reached approximately VND 1,200 trillion? With an increase of over 30% from the previous year, the demand for effective trading strategies, such as HIBT Vietnam bond candlestick pattern recognition, has never been more pertinent.

In this comprehensive guide, we will delve into the various aspects of candlestick patterns, focusing specifically on high-impact trading (HIBT) strategies within the Vietnamese bond market. You will gain valuable insights into recognizing patterns, enhancing your trading strategies, and ultimately improving your investment returns.

What Are Candlestick Patterns?

Candlestick patterns are visual representations of price movements within a specified timeframe and are crucial for technical analysis. Each candlestick provides detailed information including opening price, closing price, high, and low, which helps traders interpret market sentiment.

- Body: The filled or hollow part representing the opening and closing prices.

- Wicks: Lines extending above and below the body showing the highest and lowest prices during that period.

- Bullish vs. Bearish: A bullish pattern indicates potential price increases, while a bearish pattern signals potential decreases.

Understanding these components is essential for recognizing patterns that could signal market movements. According to HIBT, proper analysis of these patterns can increase trading success rates by up to 60%.

Key Candlestick Patterns to Recognize

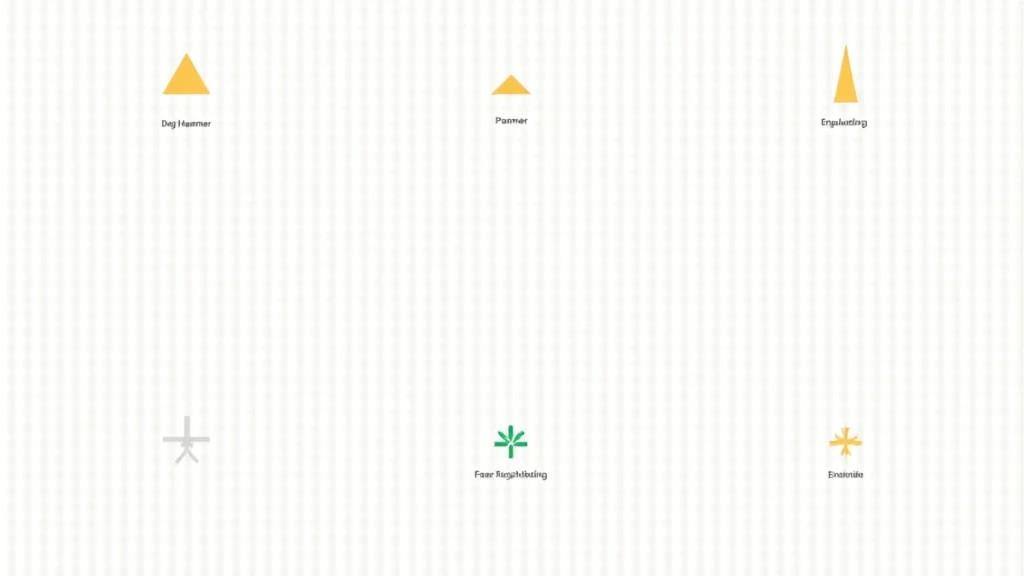

Among the numerous patterns available, certain key candlestick formations stand out when trading bonds:

- Doji: Indicates indecision in the market and can signal a reversal if followed by a strong movement.

- Hammer: Shows potential price reversals, often occurring at market bottoms.

- Engulfing Patterns: Suggest strong reversals where the second candle engulfs the first.

Recognizing these patterns early increases your potential to execute successful trades in the Vietnamese bond market. For instance, a Hammer pattern might signify a great opportunity to buy before a price increase.

Implementing HIBT Strategies

Now that you recognize essential candlestick patterns, how do you implement HIBT strategies effectively? Here are key steps to consider:

- Market Analysis: Before acting on any pattern, conduct thorough market analysis, including historical performance and economic indicators.

- Use Multiple Timeframes: Confirm patterns by analyzing them across different timeframes to increase reliability.

- Leverage Tools: Consider using trading tools and platforms, such as trading simulators or portfolio management apps, which can enhance pattern recognition.

Integrating these strategies into your trading routine can bolster your gains in the fast-paced Vietnamese market.

Market Dynamics in Vietnam

In Vietnam, the bond market demonstrates robust growth, with user numbers skyrocketing—an approximate growth rate of 25% annually. As more individuals enter the trading arena, understanding market patterns becomes essential. Current data suggests that retail investors contribute over 40% to market liquidity.

By utilizing HIBT Vietnam bond candlestick pattern recognition, traders can better navigate the complexities of this evolving market and make informed decisions.

Conclusion

Mastering HIBT Vietnam bond candlestick patterns is vital for traders aiming to optimize their investment strategies. With proper understanding and application, you can elevate your trading success. Remember to consistently assess patterns, market conditions, and leverage effective tools.

As you venture into the world of trading, always ensure that you remain informed about local regulations and consult financial advisors when necessary. The Vietnamese bond market holds great potential, and being equipped with knowledge about candlestick pattern recognition will undoubtedly give you an edge.

For further resources on trading strategies, visit HIBT. Always keep learning and evolving your strategies.

Author: Dr. Nguyen Van An

A leading expert in financial analysis with over 15 publications in trading strategy optimization. Led audits for several prominent cryptocurrency projects.