Introduction: The Need for Risks Management in Bitcoin Trading

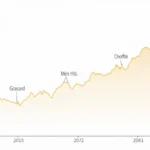

The cryptocurrency market is notorious for its volatility. In 2024, over $4.1 billion was lost to DeFi hacks alone, making it crucial for traders to adopt robust risk management strategies. HIBT’s Bitcoin trading risk management tools come into play here, offering traders a systematic approach to safeguard their investments.

The rise of Bitcoin in the Vietnamese market, witnessing a 20% increase in user engagement over the previous year, underlines the pressing need for effective risk management. Understanding how to effectively navigate these risks can profoundly affect your trading success.

Understanding HIBT’s Risk Management Tools

HIBT (Holdings International Blockchain Technologies) offers a variety of tools designed specifically for Bitcoin traders. These tools help traders minimize risks and maximize profits through informed decision-making.

1. The Role of Analytics in Risk Management

Data analytics plays a pivotal role in HIBT’s risk management offerings. By using predictive analytics, traders can forecast market trends and adjust their strategies accordingly. Think of it as having a crystal ball that provides insights into future market moves.

2. Portfolio Diversification

One of the oldest tricks in the investment book is diversification. HIBT encourages traders to not put all their eggs in one basket. When you spread your investments across multiple cryptocurrencies, you’re less likely to suffer catastrophic losses from any single asset’s downturn.

3. Stop-Loss Orders: A Safety Net

Stop-loss orders remain a vital safety tool in the Bitcoin trading arsenal. By setting these orders, traders can limit their potential losses if market conditions turn adverse. It’s akin to having insurance that protects your assets when the market tumbles.

Real-World Application: HIBT in Action

Let’s break down how these tools work in real-world trading scenarios:

- Scenario A: A trader invested heavily in Bitcoin but noticed a sudden spike in volatility. By utilizing HIBT’s stop-loss orders, they managed to limit their losses effectively.

- Scenario B: A savvy trader utilized the analytics tools offered by HIBT. They predicted a downturn in Bitcoin prices and opted to diversify their portfolio before the market correction.

Integration with Vietnamese Market Trends

With Vietnam being one of the fastest-growing cryptocurrency markets, it is vital to tailor HIBT’s tools to align with local market conditions. For example, given Vietnam’s regulatory landscape and user demographics, traders can employ HIBT’s tools to navigate potential risks effectively.

Reports indicate that Vietnam’s crypto user base expected to double by 2025, making risk management more crucial than ever. Adopting HIBT’s tools will be key in leveraging this growth.

The Future of Risk Management in Crypto Trading

As we look ahead, it becomes evident that risk management in cryptocurrency trading, particularly Bitcoin, will evolve significantly. Innovations within HIBT’s toolset offer exciting possibilities for traders. From machine learning to automated decision-making, the future is ripe for enhancing risk management practices.

Moreover, as the market matures, Vietnamese regulations are expected to tighten. Thus, equipping yourself with tools that adhere to international standards while complying with local regulations will give you an edge in the competitive landscape.

Conclusion: Investing Wisely in Bitcoin Through HIBT

As the world of cryptocurrency continues to expand, so does the need for effective risk management strategies. HIBT’s Bitcoin trading risk management tools stand out in protecting investments and ensuring sustainable growth.

Remember, navigating the crypto market isn’t just about making profits; it’s about protecting your assets and making informed decisions. Adopting the right risk management framework can make all the difference.

For more information on HIBT’s offerings, visit HIBT’s official website. Explore the tools that can turn your Bitcoin trading experience from risky to rewarding. Let’s thrive in this exciting cryptocurrency journey!