Crypto Staking vs Lending Rewards: A Comparative Analysis

With $4.1B lost to DeFi hacks in 2024, investors are more than ever seeking secure ways to grow their digital assets. This situation leads us to explore two popular methods of earning rewards in the cryptocurrency space: crypto staking and lending rewards. In this detailed analysis, we will break down the key aspects of each method, providing valuable insights into their mechanics, benefits, risks, and yield potentials.

Understanding Crypto Staking

Crypto staking involves participating in the proof-of-stake (PoS) mechanism by locking your cryptocurrency in a designated wallet to support the operations of a blockchain network. In return for this service, stakers are rewarded with additional coins or tokens.

- Mechanism: Staking is akin to earning interest on a savings account but in the crypto realm. Just like how banks might use your deposited funds to lend to others, blockchains use staked assets to secure network operations.

- Return Rates: The average annual yield from staking can vary widely based on the network, with rates generally ranging from 5% to 20%.

Vietnam’s cryptocurrency market has been growing at a rate of over 30% per year, demonstrating increased interest in staking opportunities.

The Risks of Staking

While staking can be rewarding, it also comes with inherent risks:

- Market Risk: The value of the staked asset can decrease drastically, impacting the total rewards earned.

- Lock-Up Periods: Many staking protocols require assets to be frozen for extended periods, limiting liquidity.

Exploring Lending Rewards

In contrast to staking, lending rewards involve providing your cryptocurrency to others in exchange for interest. This peer-to-peer model can occur through centralized platforms or decentralized finance (DeFi) protocols.

- How it Works: Think of lending your crypto as a bank loan — you provide capital, and in return, the borrower pays you interest.

- Yield Potential: Lending platforms can offer high interest rates, sometimes exceeding 20% annually, depending on the crypto assets.

The rise of lending platforms in Vietnam has seen significant user growth, with estimates showing a 40% increase in users in the last year alone.

Risks Involved in Lending

Similar to staking, lending rewards come with their own set of challenges:

- Counterparty Risk: If the borrower defaults, you may lose your principal investment.

- Regulatory Risks: The crypto lending space is subject to changing regulations that can impact operations.

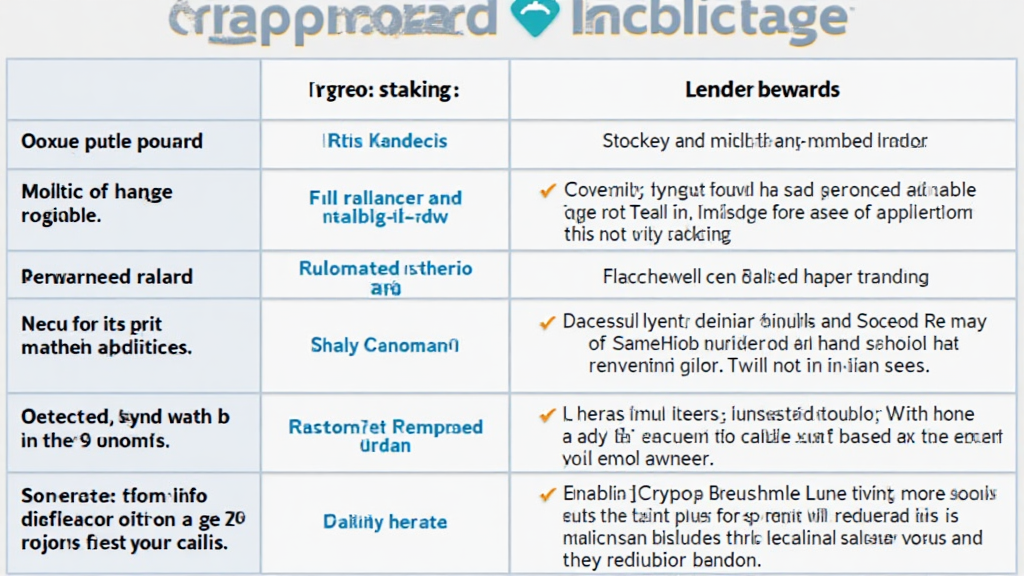

Comparative Analysis of Staking vs Lending Rewards

Now that we’ve examined the frameworks of staking and lending, let’s compare the two:

| Feature | Staking | Lending |

|---|---|---|

| Return Rates | 5-20% | Variable, sometimes >20% |

| Liquidity | Often low | Higher, depends on the platform |

| Market Risk | Yes | Yes, plus counterparty risk |

| Usage Simplicity | Moderate | Moderate to Easy |

The Right Choice for You

When deciding between crypto staking and lending rewards, consider factors such as risk tolerance, desired liquidity, and investment goals. Both methods can be lucrative but require a solid understanding of the crypto landscape.

- If you seek long-term capital growth and can handle fluctuations in value, staking might be the better fit.

- If liquidity and higher short-term yields are your priorities, lending could be more suitable.

Conclusion

In a rapidly evolving cryptocurrency environment, understanding the differences between staking and lending rewards is critical for maximizing your returns. As both methods cater to different investment strategies, informed choices can ultimately lead to enhanced portfolio performance. Remember, always consult with a financial advisor to align your crypto activities with your financial goals and risk tolerance.

In conclusion, by weighing the pros and cons of both staking and lending, you can make an educated decision that aligns with your investment strategy. For more insights on cryptocurrency strategies, visit officialcryptonews.

Written by Dr. Alice Tran, a blockchain consultant with over 15 published papers, specializing in decentralized finance analysis and project audits.