Crypto Lending Rates in Vietnam: Trends and Insights

As the cryptocurrency landscape continues to evolve, so too do the opportunities for investors in regions like Vietnam. With a notable surge in interest surrounding crypto lending, it’s crucial to understand the current lending rates, market dynamics, and the factors influencing these rates.

Understanding Crypto Lending and Its Importance

In the simplest terms, crypto lending allows users to lend their cryptocurrency in exchange for interest payments. Think of it like putting your money into a savings account at a bank, but instead, you’re putting your digital assets on the line. According to recent studies, crypto lending volumes reached approximately $4 billion in Vietnam in 2024, indicating a significant growth trend in this sector.

Current Crypto Lending Rates in Vietnam

As of early 2025, crypto lending rates in Vietnam range between 6% to 12% annually, varying by the type of cryptocurrency and the platform used. For instance, stablecoins might offer lower rates compared to high-volatility assets like Bitcoin or Ethereum. The fluctuation of these rates can be compared to the local fiat market, reinforcing the dynamic nature of this growing sector.

Average Lending Rates (Q1 2025):

Factors Influencing Crypto Lending Rates

The crypto lending rates in Vietnam are influenced by various factors, including:

- Market Demand and Supply

- Interest from Institutional Investors

- Regulatory Environment

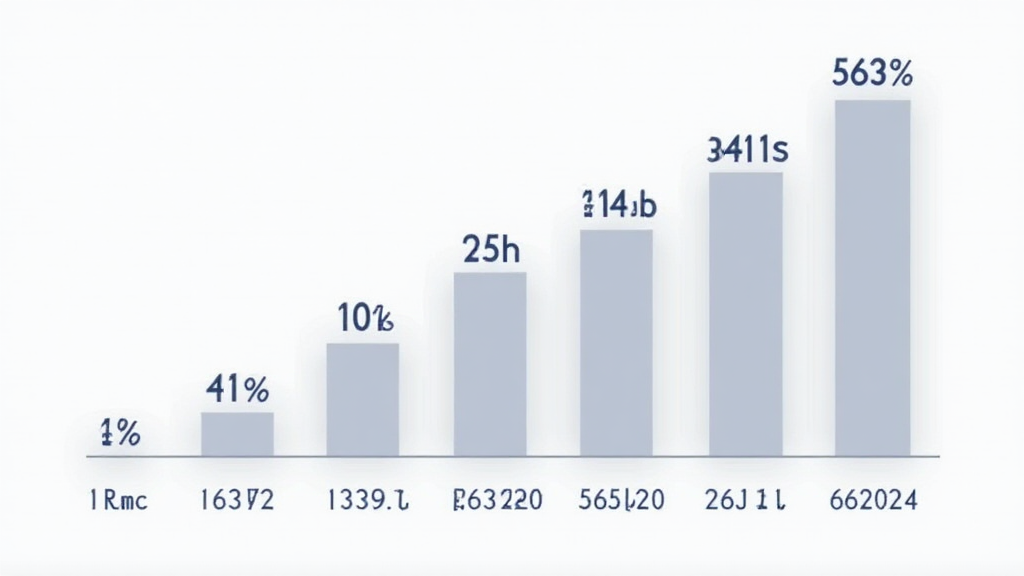

As the crypto user base expands in Vietnam—showing an impressive 100% growth rate over the past year—the competition among platforms increases, which can lead to more favorable rates for borrowers and lenders alike.

Future Projections for Crypto Lending in Vietnam

Looking ahead, experts anticipate that crypto lending will continue to grow, with rates projected to become more favorable as more platforms enter the market. A report suggests that by 2026, lending volumes could reach up to $10 billion, making Vietnam one of the largest crypto lending markets in Southeast Asia.

Security Standards for Crypto Lending Platforms

Security remains a top priority for crypto lending platforms. Adhering to standards such as tiêu chuẩn an ninh blockchain is crucial for building user trust. Regulations are tightening, and platforms that comply with best practices are more likely to attract users.

Conclusion

In conclusion, the landscape of crypto lending rates in Vietnam presents a promising scenario for both investors and borrowers. With a healthy interest rate range and an expected increase in market participation, now is an optimal time for cryptocurrency users to explore these financial options. Stay tuned for more updates on crypto lending rates as our analysis unfolds at officialcryptonews.

Author: Dr. Nguyen Minh, a blockchain expert with over 15 published papers on cryptocurrency markets and a lead auditor for several high-profile crypto projects.