HIBT Order Book Optimization for Crypto Platforms

With the ever-expanding landscape of digital assets, the need for effective trading mechanisms has never been more critical. In 2025 alone, billions have been lost in trading inefficiencies and hack incidents, highlighting a pressing issue for crypto exchanges. It’s time for innovative solutions. Enter HIBT order book optimization – a strategy designed to enhance liquidity, reduce slippage, and improve user experience in crypto trading.

Understanding HIBT: What is it?

HIBT, or High-Intensity Blockchain Technology, represents a series of advanced methodologies aimed at optimizing order books on cryptocurrency platforms. In essence, order book optimization refers to structuring the list of buy and sell orders in a manner that maximizes trading efficiency and liquidity. This follows the blockchain principle of creating transparent and immutable records while ensuring security – tiểu chuẩn an ninh blockchain.

Why Order Book Optimization?

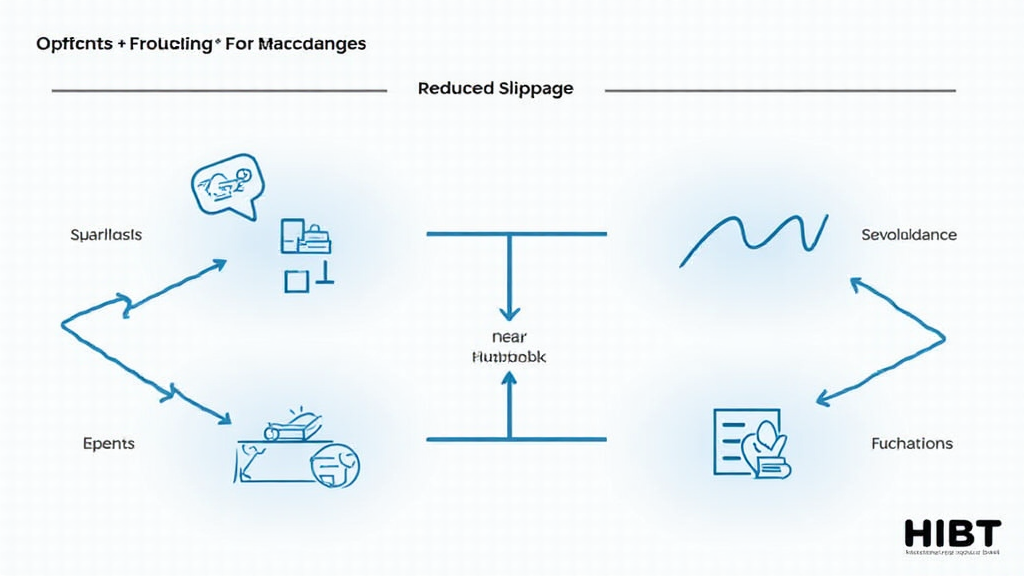

- Liquidity Enhancement: A well-optimized order book will allow for higher trading volumes and quicker transactions, essential for user retention.

- Reduced Slippage: Proper optimization minimizes the price difference between expected and actual trade prices, providing users a better trading experience.

- Market Depth Improvement: Enhance the visibility of buy and sell orders within the market, ensuring better trade execution.

Analyzing Current Trends in Vietnam’s Crypto Market

Vietnam is experiencing a fascinating evolution in its crypto market. According to Statista, the user growth rate in Vietnam’s cryptocurrency sector was approximately 25% in 2024, ranking it among the fastest-growing markets in the region. As a result, implementing HIBT order book optimization in this market can significantly impact trading efficiency and market stability.

Steps to Implement HIBT Order Book Optimization

Here’s a breakdown of essential strategies for optimizing your crypto platform’s order book:

- Data Analysis: Evaluate trading patterns and volume to understand user behavior.

- Algorithm Integration: Utilize algorithms that automatically adjust orders based on market changes.

- User Interface Design: Ensure that the order book is easy to navigate to enhance user engagement.

- Feedback Loop: Continuously gather user feedback to fine-tune the optimization process.

Challenges in Order Book Optimization

Implementing HIBT order book optimization is not without its challenges. Some of the notable issues include:

- Market Volatility: Rapid fluctuations in the crypto market can affect the effectiveness of your optimization strategies.

- Security Concerns: Enhancing order book functionality involves risk. Following the tiểu chuẩn an ninh blockchain is essential to safeguard user data.

- User Adoption: Convincing users to shift to a new platform can be challenging due to established preferences.

Case Study: Successful Order Book Optimization

Many exchanges have successfully implemented order book optimization strategies. A notable case is Binance, which incorporated advanced algorithms to enhance order matching speeds, resulting in a 40% increase in trading volume. Similarly, Huobi has integrated machine learning techniques to better forecast order flow, providing users with an unmatched trading experience.

Metrics to Watch

When measuring the success of order book optimization, keep these key metrics in mind:

- Trade Execution Speed: The time it takes for an order to be filled.

- Market Depth: The amount of buy and sell orders at various price levels.

- User Satisfaction Survey Results: Regularly polling users for feedback on their experience can provide valuable insights.

The Future of HIBT Order Book Optimization

Looking forward, the future of HIBT order book optimization appears bright. As technology advances, improved data analysis, better trading algorithms, and enhanced user interfaces can all contribute to an unprecedented trading experience. For instance, integrating quantum computing into trading systems might provide insights that were previously unattainable, taking optimization to a whole new level.

Conclusion: Embracing the HIBT Revolution

In conclusion, HIBT order book optimization serves as a game-changing strategy for cryptocurrency platforms. By enhancing liquidity, reducing slippage, and improving user experiences, crypto exchanges not only secure their positions in the market but also contribute to a healthier trading ecosystem.

With Vietnam’s crypto market burgeoning, now is the time for exchanges to realize the potential of HIBT order book optimization. For more insights and innovative strategies, visit hibt.com. Not financial advice. Consult local regulators.

Author: Dr. James Chen, a blockchain security expert with over 20 published papers and leading audits for major crypto projects.