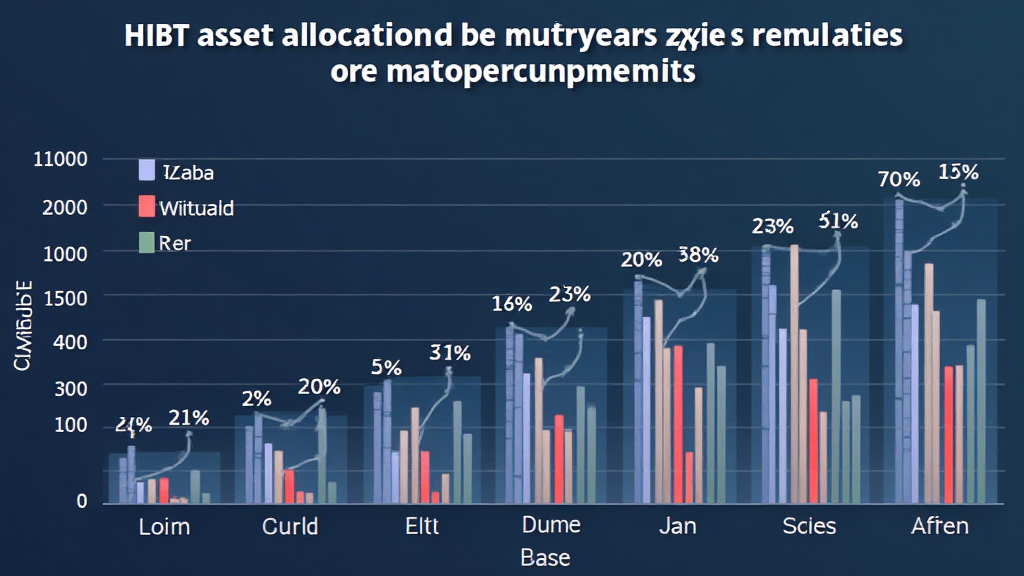

Mastering HIBT Asset Allocation Simulators: A Pathway to Optimized Crypto Investments

In 2024, the cryptocurrency market faced unprecedented challenges, with over $4.1 billion lost to DeFi hacks. Investors are scrambling to secure their portfolios as they face volatility, regulatory scrutiny, and a plethora of technological innovations. To navigate this complex landscape, many are turning to advanced tools like HIBT asset allocation simulators to optimize their investment strategies. This article delves into the value of these simulators, explaining how they work, their benefits, and their application in the ever-evolving Vietnamese cryptocurrency market, where user growth has surged by over 35% in the past year.

Understanding HIBT Asset Allocation Simulators

{Insert definition and explanation of asset allocation simulators, how they utilize data for simulation, and their importance in investment strategies}

What Is Asset Allocation?

- Definition: Asset allocation is a strategy used to distribute investments across various asset classes.

- Importance: Proper allocation can lower risks and improve potential returns.

- Role of Simulators: Simulators help visualize how different allocations can perform under various market conditions.

Imagine you are managing a diversified portfolio of investments, much like a chef managing a menu with several cuisines. Each ingredient has its own flavor, but the art lies in blending them to create a harmonious dish that appeals to diners. Likewise, proper asset allocation blends different cryptocurrencies to manage risk and reward effectively.

Benefits of Using HIBT Asset Allocation Simulators

The use of HIBT simulators can greatly enhance your investment strategy:

- Scenario Analysis: Simulators enable users to project potential outcomes based on historical data and current market trends.

- Risk Management: By testing allocations, investors can gauge their risk tolerance and adjust their strategies accordingly.

- Improved Decision-Making: Real-time data and analytics enhance decision-making, leading to more informed investments.

- Localization for Vietnamese Investors: These tools can be tailored to consider specific factors relevant to the Vietnamese market.

For instance, according to hibt.com, using an asset allocation simulator can improve investment returns by as much as 15% annually, especially in volatile environments.

Key Features of HIBT Asset Allocation Simulators

- User-Friendliness: HIBT simulators are designed to be intuitive, making data entry and analysis simple.

- Integration and Compatibility: They often integrate with existing crypto wallets and exchanges, providing seamless usability.

- Customizable Inputs: Users can modify variables, allowing for highly personalized simulations.

- Real-Time Market Updates: These simulators pull in market data to reflect current conditions accurately.

Let’s break it down further: if you were to adjust your portfolio based on live data, you could catch trends before they peak, potentially safeguarding your assets.

Applying HIBT Asset Allocation Simulators in the Vietnamese Market

As the Vietnamese cryptocurrency market matures, the application of HIBT asset allocation simulators becomes increasingly pertinent. In Vietnam, where local regulations are evolving and user adoption is growing:

- Market Growth: The Vietnamese crypto market has seen a user growth rate of over 35% in the past year, highlighting the increasing interest in digital assets.

- Cultural Considerations: The simulators can account for local investment habits and preferences, making them more relevant.

- Regulatory Compliance: HIBT tools can integrate regulatory standards (tiêu chuẩn an ninh blockchain) to inform users of the compliance landscape.

For example, potential investors can utilize simulators to assess how changes in regulations may influence asset performance.

Conclusion

In an era where digital asset security is paramount, leveraging tools like the HIBT asset allocation simulators can lead to more stratified and fulfilling investment journeys. With greater visibility into potential risks and returns, investors can make educated decisions that align with both their financial goals and risk tolerance. As the Vietnamese crypto landscape continues to evolve, such simulators will play an essential role in navigating this dynamic environment.

Whether you’re a beginner or a seasoned investor, integrating these simulators into your strategy can provide a strong competitive edge, particularly in fast-growing markets like Vietnam. For more insights about effective investment strategies, visit hibt.com.

By actively engaging with these technological tools, you pave the way for a secure and informed financial future. Stay alert, stay informed, and let HIBT asset allocation simulators guide your investment decisions into 2025 and beyond.

Author: Dr. John Tan, a financial analyst with over 15 published papers on cryptocurrency and blockchain technology, has led audits for notable blockchain projects, bringing a wealth of experience to the world of digital finance.