Introduction: The Rise of Crypto in Vietnam

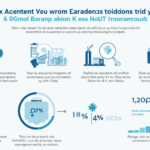

In recent years, Vietnam has established itself as a vibrant hub for cryptocurrency innovation. A staggering 1.5 million cryptocurrency users were registered in the country as of early 2023, representing an annual growth rate of 30%. This explosive rise has sparked a wave of innovations, particularly in the realm of crypto bonds. With the global market for digital assets projected to surpass $10 trillion by 2025, Vietnam’s pioneering efforts in crypto bond innovations are set to play a crucial role in this transformation.

The Mechanics of Crypto Bonds

So, what exactly are crypto bonds? Unlike traditional bonds issued by governments or corporations, crypto bonds are digital representations of debt. They utilize blockchain technology, ensuring transparency and security. Here’s the catch: similar to a bank vault securing physical assets, blockchain technology protects the integrity of the crypto bond.

Typical features of crypto bonds include:

- Smart Contracts: Automating the execution of agreements.

- Transparency: All transactions are stored on a public ledger.

- Lower Costs: Reduced intermediaries lead to lower fees.

Advantages of Vietnam’s Crypto Bonds

Vietnam’s approach to crypto bonds is focused on maximizing benefits while minimizing risks. By aligning regulatory measures with blockchain advancements, the country is setting a precedent in the financial sector. Key advantages include:

- Increased Market Efficiency: Streamlined processes reduce time and costs.

- Attractive Investment Opportunities: Crypto bonds offer yield potentials comparable to traditional bonds.

- Regulatory Compliance: The government actively promotes secure and legal frameworks.

Real-World Applications of Crypto Bonds in Vietnam

In practical terms, crypto bonds can be utilized in a variety of sectors, including:

- Infrastructure Projects: Funding essential development projects.

- Environmental Initiatives: Supporting green technology.

- Startups: Offering businesses alternative financing options.

For instance, a notable project in Vietnam involved using crypto bonds to fund renewable energy initiatives, thereby promoting sustainability while attracting foreign investments.

The Regulatory Landscape for Crypto Bonds in Vietnam

To foster a secure environment for crypto bond innovations, the Vietnamese government has taken significant steps in regulation. The State Bank of Vietnam (SBV) has been crucial in establishing frameworks that facilitate but also monitor crypto bond issuance. This proactive approach helps ensure:

- Investor Protection: Safeguarding participants in the digital asset space.

- Tax Compliance: Effective frameworks for taxing profits from crypto investments.

It’s important to note that while regulation is essential, it should not stifle innovation. The balance between oversight and freedom to experiment is vital for fostering a thriving market.

Challenges and Opportunities Ahead

Despite the promising landscape, challenges remain. Issues such as market volatility, regulatory uncertainty, and lack of education among potential investors could hinder growth. However, these challenges also present opportunities for:

- Educational Initiatives: Promoting blockchain literacy among the population.

- Innovative Solutions: Developing tech-driven methods to mitigate volatility.

Future Prospects: The Next Steps for Vietnam’s Crypto Bonds

Looking ahead, Vietnam’s crypto bond innovations are set to gain momentum. The focus will likely shift towards:

- Integrating AI with Blockchain: Enhancing data analysis capabilities.

- Expanding International Collaborations: Partnering with global entities.

According to projections from Chainalysis 2025, the Vietnamese crypto market could see a drastic increase, with crypto bonds being a significant contributor. The potential for crypto bonds to transform the investment landscape is immense.

Conclusion: Vietnam’s Role in Crypto Bond Innovations

As we move towards a future dominated by digital assets, Vietnam stands at the forefront of significant crypto bond innovations. With a robust regulatory framework, increasing public interest, and an environment ripe for investment, the future of crypto bonds in Vietnam appears promising. Embracing innovation while ensuring security is key to cultivating a thriving crypto ecosystem in the country. As we navigate these trends, it’s evident that Vietnam is poised to be a leader in shaping the future of finance.

For more insights on the evolving cryptocurrency landscape, be sure to check out our Vietnam crypto tax guide.

**Not financial advice. Consult local regulators.**