Introduction to Bitcoin Market Sentiment

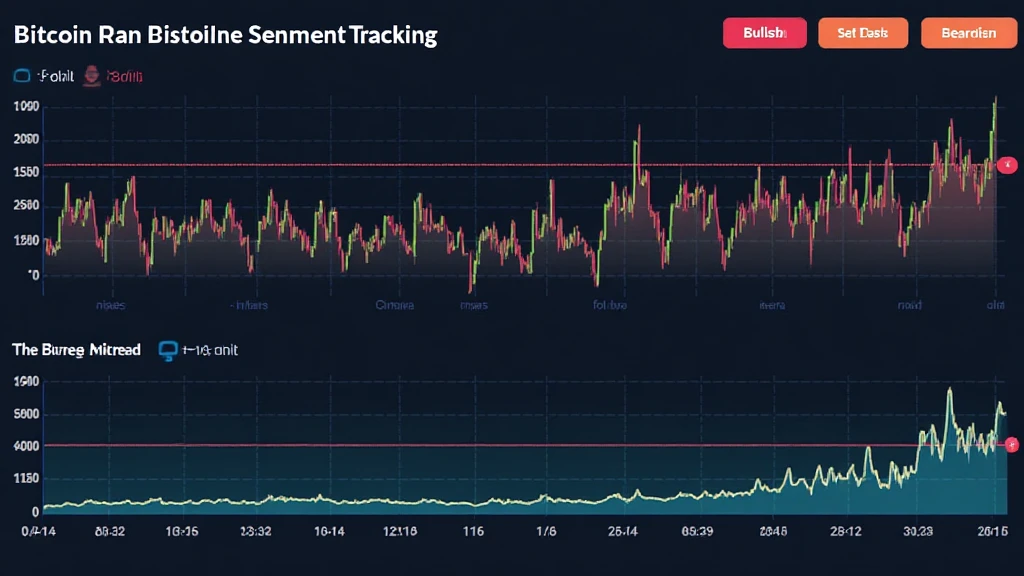

In the ever-evolving world of cryptocurrencies, understanding Bitcoin market sentiment tracking has become essential for traders and investors alike. With approximately $4.1 billion lost to DeFi hacks in 2024, the pressure to make informed decisions is higher than ever. Market sentiment refers to the overall attitude of investors toward a particular asset or market. The perception can significantly influence Bitcoin’s value, price fluctuations, and trading volume.

But what does Bitcoin sentiment mean for you? This article aims to explore the intricacies of Bitcoin market sentiment tracking, its relevance within the crypto space, and how it can aid in making more educated investment decisions.

Understanding Market Sentiment

Market sentiment encapsulates the emotions and feelings that investors hold towards Bitcoin and the broader cryptocurrency market. Sentiment analysis has been a popular trend in finance, analyzing data points to gauge overall investor mood. Here are key components to consider:

- Bullish Sentiment: When the market exhibits optimism, typically characterized by rising prices and upbeat trading volume.

- Bearish Sentiment: Conversely, a pessimistic outlook where prices fall and trading activity stalls.

- Neutral Sentiment: A market condition that suggests indecision, often leading to sideways price movements.

Tracking sentiment can be likened to looking at the tide before setting sail; understanding when to navigate through bullish waters or bearish waves is vital.

Methods of Tracking Bitcoin Market Sentiment

There are several methodologies for tracking Bitcoin market sentiment. Here are a few of the most effective:

- Social Media Analysis: Platforms like Twitter and Reddit serve as barometers for public sentiment. Tools such as Hibt.com aggregate sentiments based on trending comments and posts.

- Sentiment Analysis Tools: Various algorithms analyze historical trading patterns, investor emotions, and even news articles to derive sentiment scores.

- Market Metrics: Examining trading volume, volatility, and on-chain metrics can provide insights into current market sentiments.

By paying attention to these indicators, investors can better anticipate the potential directions of the Bitcoin market.

The Role of Sentiment in Trading Strategies

Sentiment plays a crucial role in the development of trading strategies. Here are a couple of ways sentiment analysis informs decision-making:

- Entry and Exit Points: Sentiment can help traders determine when to enter or exit positions. A high bullish sentiment may indicate a good entry point, while bearish sentiment may suggest it’s time to sell.

- Risk Management: Understanding market sentiment assists in positioning assets safely. For instance, high volatility during negative sentiment may necessitate tighter stop-loss limits.

Much like a ship’s captain who reads the weather to avoid storms, a savvy investor uses sentiment to navigate through the volatile waters of cryptocurrency.

Real-Time Sentiment Tracking: A Case Study

To exemplify the effectiveness of sentiment tracking, consider a case study involving the Bitcoin price surge during early 2025. During this timeframe:

- Bitcoin’s Price: Increased from $30,000 to $50,000 within just three weeks.

- Sentiment Score: Analyzed using various tools, exhibited a shift from 0.2 (bearish) to 0.8 (bullish).

- Investor Response: Increased trading volume on exchanges was noted, doubling average volumes.

This surge provides a clear link between sentiment and market movement — something all traders must factor into their strategies.

Global Market Sentiment: The Vietnamese Perspective

As cryptocurrency adoption continues to bloom, emerging markets such as Vietnam are critical to observe. In Vietnam:

- User Growth Rate: The country saw a 200% growth in crypto users last year.

- Investment Trends: Many Vietnamese investors are exploring Bitcoin as a diversification strategy amid economic volatility.

Through sentiment tracking in Vietnam, it’s evident that local sentiment can influence broader market trends — especially as global investments begin to evaluate regional performance.

Tools for Bitcoin Market Sentiment Analysis

Using analytical tools can streamline your Bitcoin market sentiment tracking process. Here are some popular options:

- Crypto Sentiment Tracker: Offers detailed insights on sentiment, trends, and market indicators.

- Charting Tools: Platforms such as TradingView, which combine technical analysis with sentiment indicators.

- Social Media Analysis Tools: Sites like LunarCRUSH aggregate social media data to show real-time sentiment scores.

For effective investments, adopting these tools can provide a competitive edge by allowing traders to act promptly on shifts in sentiment.

Final Thoughts on Bitcoin Market Sentiment Tracking

In conclusion, Bitcoin market sentiment tracking is far from a mere trend; it is an essential aspect of modern trading strategies. Investors who embrace sentiment analysis can better navigate the choppy waters of cryptocurrency trading.

As Vietnam’s market grows, understanding both local and global sentiment will be crucial for future investors in the space. Adapting to these dynamic elements is not just beneficial — it is imperative for success in the ever-changing crypto landscape.

For more information on Bitcoin market sentiment tracking and related topics, visit officialcryptonews.

About the Author

Đỗ Minh Tuấn is a respected cryptocurrency analyst with over 10 published papers focusing on market sentiment and its impact on trading strategies. He has also led several major projects in crypto auditing, emphasizing security and investor trust.