Introduction

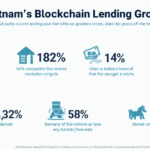

In recent years, Vietnam has emerged as a prominent player in the global crypto market, with a notable increase in investor interest and market activity. According to a recent report, the country’s crypto user base has skyrocketed by 300% in the past year, showcasing the immense potential of the Vietnam crypto market liquidity. With rapid technological advancement and favorable regulations, what does the future hold for cryptocurrencies in Vietnam? Let’s delve deeper into this topic.

The Growth of Cryptocurrency in Vietnam

The Vietnamese government has started to embrace blockchain technology, paving the way for a more robust crypto ecosystem. As of 2025, the growth rate of crypto investments in Vietnam is estimated to reach 25%, as more users become aware of the benefits of digital currencies. This growth can be compared to the initial popularity of smartphones in Vietnam, which transformed communication in a short period.

- Government initiatives supporting blockchain innovation

- Rising number of crypto exchanges catering to Vietnamese users

- Increased public awareness of cryptocurrency benefits

Understanding Crypto Market Liquidity

Market liquidity refers to how quickly and easily assets can be bought or sold in the market without affecting their price significantly. In the context of the Vietnam crypto market, liquidity indicates the ease with which traders can execute orders. High liquidity levels ensure that trades are carried out efficiently, benefiting both buyers and sellers.

Factors Affecting Liquidity in Vietnam’s Crypto Market

Several factors contribute to the liquidity of the Vietnam crypto market:

- Trading Volume: Higher trading volumes indicate active participation and thus greater liquidity.

- User Trust: Trust in crypto exchanges and the overall market fosters more significant trading activities.

- Market Depth: A deeper market with multiple buy and sell orders at varying prices allows for smoother transactions.

The Role of Technology in Enhancing Liquidity

Advancements in blockchain technology play a crucial role in enhancing liquidity in Vietnam’s crypto market. Features such as smart contracts and decentralized exchanges (DEXs) have revolutionized how trades are executed. For instance, DEXs have emerged as a popular choice among investors, offering reduced fees and better privacy compared to traditional exchanges.

Smart Contracts and Their Impact

Smart contracts, which are self-executing contracts with the agreement directly written into code, facilitate trustless transactions. This technology minimizes the need for intermediaries, leading to quicker and more efficient trading processes, which in turn enhances liquidity.

Regulatory Environment in Vietnam

As the Vietnam crypto market evolves, so does the regulatory landscape. The government has been proactive in establishing guidelines to foster innovation while ensuring user protection. These regulations create a more stable environment that encourages both local and foreign investments.

- Development of clear regulations regarding cryptocurrency trading and taxation.

- Increased collaboration between government agencies and blockchain professionals.

- Focus on security measures to combat fraud and protect consumer interests, such as adopting tiêu chuẩn an ninh blockchain.

Future Prospects of Vietnam’s Crypto Market Liquidity

The future of the Vietnam crypto market liquidity appears promising, with several trends indicating sustained growth:

- 2025’s Top Altcoins: As innovative projects emerge, identifying the next top-performing altcoins can position traders for success in the market.

- Growing Institutional Interest: Financial institutions are beginning to explore the crypto sphere, adding significant liquidity to the market.

- Enhanced User Experience: Improved trading platforms and services will attract more participants, further driving liquidity.

Conclusion

In conclusion, the liquidity of the Vietnam crypto market is on an upward trajectory, fueled by technological innovation, user growth, and a supportive regulatory framework. As more investors enter the space and new projects come to life, the landscape will continue to evolve. The responsiveness of the market to investor needs and the effectiveness of regulatory measures will profoundly influence future developments. Stay tuned for the latest updates as we explore what lies ahead in Vietnam’s vibrant crypto ecosystem.

For more insights and updates, visit officialcryptonews.

About the Author

Dr. Nguyễn Văn An is a blockchain specialist with over 15 years of experience in the field. He has published more than 20 research papers focusing on cryptocurrency trends and is known for spearheading prominent auditing projects within the blockchain domain.