Introduction: The Rise of Blockchain Bonds in Vietnam

In recent years, Vietnam has emerged as a significant player in the blockchain arena, particularly in the realm of bond issuance. As reported, over $4.1 billion was lost to various hacks in the DeFi space in 2024, highlighting the urgent need for a robust financial framework that ensures security and transparency. This article serves to navigate through the latest trends and insights concerning Vietnam’s blockchain bond issuance, elucidating the standards integral to its growth.

Understanding the intricacies of blockchain bond issuance in Vietnam is not merely an academic exercise; it holds profound implications for the future of finance in Southeast Asia, especially as the region witnesses significant user growth rates in digital finance. The current landscape presents a unique opportunity for investors, regulatory bodies, and issuers alike to leverage blockchain technology.

The Framework of Blockchain Bonds

Blockchain bonds integrate traditional debt instruments with innovative blockchain technology, enabling a secure and transparent issuance process. But why are these bonds gaining traction?

- Efficiency: Transactions can be executed in a fraction of the time traditional bonds would take.

- Transparency: All parties can verify the authenticity of the bonds on a public ledger.

- Cost-Effectiveness: Reduced intermediary costs lead to lower overall expenses for issuers.

The Vietnamese Regulatory Landscape

The issuance of blockchain bonds in Vietnam is underpinned by a complex regulatory framework aimed at ensuring security. With recent guidelines introduced by the State Securities Commission (SSC), issuers must comply with the tiêu chuẩn an ninh blockchain to safeguard investor interests. Let’s break down some key regulations:

- Issuers must register their bonds on a designated blockchain.

- Periodic audits are mandatory to maintain transparency and accountability.

- Smart contracts used in bond issuance must adhere to strict security protocols.

Evaluating Market Potential

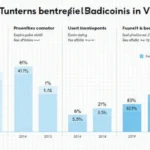

According to a recent report by Statista, Vietnam experienced an impressive user growth rate of 45% in digital finance applications within the past year. Here’s a snapshot of the regional growth:

| Country | User Growth Rate (%) |

|---|---|

| Vietnam | 45 |

| Thailand | 35 |

| Indonesia | 30 |

The rising interest in blockchain technology has created a fertile ground for the implementation of blockchain bonds.

Case Studies of Successful Issuance

Notable examples of blockchain bond issuance can help illustrate the potential impact in Vietnam:

- Example A: A local tech firm raised $10 million via blockchain bonds, significantly reducing transaction costs.

- Example B: A government agency successfully tested a pilot program, utilizing smart contracts for bond issuance.

Technological Considerations

When considering the technological aspects that facilitate blockchain bond issuance, it’s essential to identify key components that ensure security:

- Immutable Ledger: Prevents tampering and enhances trust.

- Smart Contract Audits: To ensure accuracy and compliance.

- Encryption: Safeguarding sensitive data and investor information.

How to Audit Smart Contracts Effectively

As blockchain bonds rely heavily on smart contracts, understanding how to audit them is critical. Here’s a brief checklist:

- Review code against specifications.

- Conduct vulnerability assessments.

- Test for performance under load.

Future Outlook for Blockchain Bonds in Vietnam

Looking forward, analysts anticipate that blockchain bond issuance will continue to grow, driven by technological advancements and increasing regulatory clarity. A compelling aspect of this evolution is the comparative benefits of blockchain bonds over traditional financial instruments:

- Lower interest rates due to reduced risk.

- Broader accessibility for small and medium enterprises.

- Adoption of green finance initiatives via blockchain.

Conclusion: Positioning Vietnam in the Global Market

As we have explored, the potential for blockchain bond issuance in Vietnam is vast, but it hinges on the careful balancing of innovation with regulatory compliance. With the backing of both local businesses and government initiatives, Vietnam is poised not just to transform its financial landscape but also to position itself as a leader in the global blockchain community. In a world where over $4.1 billion has been lost to DeFi hacks in 2024 alone, the transition towards more secure financing options like blockchain bonds presents a noteworthy shift in the paradigm of how we think about investments and security.

The insights and trends outlined here not only underline the importance of blockchain bonds in Vietnam but also serve as a structured guide for stakeholders looking to navigate this emerging market. For anyone interested in forging ahead in this domain, understanding the tiêu chuẩn an ninh blockchain is imperative.

For further insights into cryptocurrency taxation in Vietnam, be sure to read our guide for a comprehensive look at how to align with local regulations.

Always remember that this article does not constitute financial advice. Please consult your local regulators for advice tailored to your situation. As technology advances, so does the responsibility of staying informed.