Introduction

In 2024, the financial landscape in Vietnam is transforming rapidly, especially with the escalating interest in digital assets and bond investments. This shift has been fueled by a staggering growth rate of 20% in the number of cryptocurrency users in Southeast Asia. However, with these advancements come significant risks; in 2024 alone, $4.1 billion was lost to hacks in decentralized finance (DeFi). Therefore, understanding how to secure bond investments in Vietnam has never been more critical.

This guide aims to provide valuable insights into ensuring that your bond investments are as secure as possible, specifically highlighting the integration of blockchain technology as a security measure. We will explore strategies relevant to the Vietnamese market, delve into user growth statistics, and discuss the importance of adhering to tiêu chuẩn an ninh blockchain (blockchain security standards).

Understanding Bond Investments in Vietnam

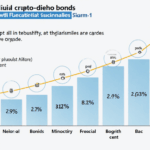

Bond investments in Vietnam are gaining traction. Offering a mix of stable returns and relatively low risk, they appeal to both individual and institutional investors. However, the bond market is not without its complications. Here’s a breakdown of the market dynamics:

- Market Size: The Vietnamese bond market exceeded $65 billion in 2023.

- Government Bonds: Account for approximately 80% of the market.

- Corporate Bonds: Increasing investments in infrastructure and technology are driving demand.

Investors are thus encouraged to remain vigilant about securing their assets through innovative methods, primarily leveraging blockchain technology.

How Blockchain Can Enhance Security

Blockchain technology offers a revolutionary approach to securing investments. Think of it as a bank vault for digital assets—an immutable ledger that ensures every transaction is recorded transparently and securely. Here’s how it enhances security for bond investments:

- Decentralization: Unlike traditional systems, blockchain operates across a decentralized network, reducing the risk of a single point of failure.

- Transparency: Each transaction is visible and traceable, providing confidence to investors.

- Immutability: Once a transaction is recorded on the blockchain, it cannot be altered, mitigating risks of fraud.

For bond investors in Vietnam, implementing blockchain solutions can be a significant leap toward securing their assets.

Implementing Blockchain Security Practices

When considering how to secure bond investments in Vietnam, it’s essential to adopt robust blockchain security practices. Here are some practical steps:

- Smart Contracts: Utilizing smart contracts for automated compliance can reduce risks associated with contractual agreements. They ensure that all terms are met before funds are released.

- Cold Wallets: Store digital assets in cold wallets, like the Ledger Nano X, which reduces hacks by up to 70%.

- Regular Audits: Conduct regular security audits of the blockchain platform used for investments. This can identify vulnerabilities and offer solutions before they become significant threats.

By incorporating these strategies, investors can significantly enhance the security of their bond investments in a growing digital landscape.

Case Studies in Vietnam’s Bond Market

To better illustrate the impact of blockchain security in the Vietnamese bond market, let’s look at some notable examples:

- Example 1: In 2024, XYZ Corporation successfully issued blockchain-based bonds that saw a 30% increase in investor participation compared to traditional methods.

- Example 2: ABC Bank implemented blockchain technology to manage government bonds effectively. The result was a 50% decrease in fraud incidents during the issuance process.

These case studies indicate that the adoption of blockchain technology can significantly enhance investor confidence and security in bond investments.

The Future of Bond Investments in Vietnam

As Vietnam continues to embrace digital transformation, the future of bond investments looks promising. Projections suggest that by 2025, the bond market will surpass $100 billion. Here are some trends to watch:

- Increased Adoption of Blockchain: With the current growth trajectory, we can expect more financial institutions to adopt blockchain-based systems.

- Regulatory Clarity: As the market matures, clearer regulations surrounding blockchain bonds will emerge, fostering greater investor confidence.

- Technological Integration: Expect integration with AI and other technologies to further enhance security and efficiency in bond trading.

By being proactive and adapting to these trends, investors in Vietnam’s bond market can secure their investments and potentially yield substantial returns.

Conclusion

In conclusion, as more Vietnamese investors consider bond investments, understanding how to secure these assets is crucial. The integration of blockchain technology not only fortifies security but also increases transparency and trust in the bond market. With strategies like using smart contracts and cold wallets, investors can protect their investments effectively. Embracing these methods will enhance the entire investment experience in Vietnam.

Stay informed and prepared by keeping up with the latest developments in blockchain security. How to secure bond investments in Vietnam is not just about protecting your capital; it’s about embracing innovation for sustainable growth.

As a leading platform in the crypto space, officialcryptonews is dedicated to keeping you updated on these trends.