Introduction

As of 2024, over 3.5 million Vietnamese individuals are actively engaging with cryptocurrency markets, indicating a robust growth rate surpassing 50% annually. With global economic shifts influencing local bond markets, HIBT Vietnam bond macroeconomic factor correlations have garnered considerable interest. This article aims to clarify the connections between HIBT bonds and significant macroeconomic indicators, revealing their potential implications for investors and policymakers alike.

Understanding HIBT Bonds

HIBT bonds, or High-Interest Bond Trusts, are innovative financial instruments in Vietnam aiming to attract investor capital through favorable interest rates and diversification in earnings. The growing demand for bond markets reflects an evolving economy, prompting a deeper analysis of the macroeconomic factors influencing these bonds.

The Role of Interest Rates

Interest rates significantly impact bond valuations. When rates rise, bond prices typically fall. Conversely, as rates decrease, bonds become more attractive. For instance, in 2023, Vietnam experienced fluctuations in its key interest rates:

- 4.5% – Average lending rate

- 3.2% – Average deposit rate

- 5.0% – Government bond yield

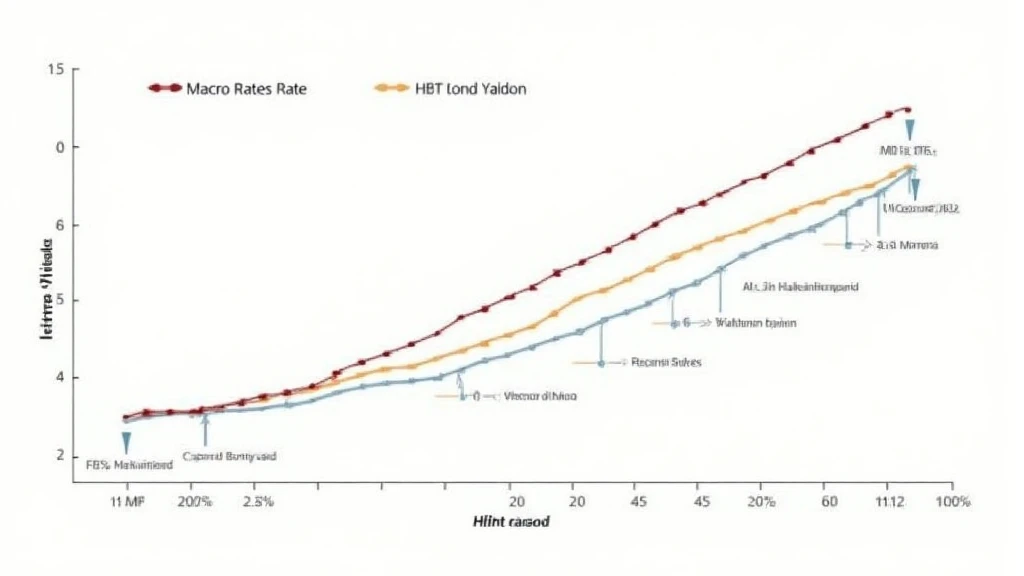

Understanding these dynamics is crucial for investors looking into HIBT bonds. As illustrated in the chart below, the inverse relationship between prevailing interest rates and bond yields is evident:

Economic Growth and Inflation

Vietnam’s GDP growth rate has been remarkable, averaging 6% over the past decade. However, inflation has posed challenges, averaging 3.5% in 2023. This affects purchasing power and investment strategies. For HIBT bonds, being aware of inflation trends is essential since high inflation might diminish returns. Here’s the correlation breakdown:

- GDP Growth: Higher growth can lead to increased bond demand.

- Inflation Impact: High inflation can reduce real yields on bonds.

Foreign Investment Influence

According to the latest reports, Vietnam has seen a surge in foreign investments, exceeding $28 billion in 2023. This influx of capital impacts the bond market significantly. HIBT bonds are often seen as a safe harbor for these investments, responding to external macroeconomic factors such as:

- Exchange rate fluctuations

- Global economic trends

- Trade policies

Local Market Dynamics

The Vietnamese economy’s structure plays a pivotal role in shaping bond market dynamics. As local entrepreneurs gain traction, the demand for HIBT bonds is expected to rise. An essential aspect is the correlation between domestic economic initiatives and bond performance. For example, government investments in infrastructure projects directly boost economic activity, thereby increasing bond attractiveness.

Case Studies and Data Analysis

To further explore the HIBT Vietnam bond macroeconomic factor correlations, we present case studies highlighting various periods of economic shifts. Data collected reveals:

- 2022: Inflation was at 2.8%, and GDP growth soared to 7.1%.

- 2023: Inflation surged to 3.5%, leading to corrections in bond yield benchmarks.

Using Real Data to Predict Trends

Effective forecasting requires understanding past and current data, illustrated via this table:

| Year | GDP Growth (%) | Inflation (%) | Bond Yield (%) |

|---|---|---|---|

| 2021 | 2.9 | 1.8 | 4.5 |

| 2022 | 7.1 | 2.8 | 4.1 |

| 2023 | 5.5 | 3.5 | 5.0 |

This data sheds light on existing correlations, guiding investors to make informed decisions regarding HIBT bond investments.

Conclusion

In conclusion, understanding the HIBT Vietnam bond macroeconomic factor correlations is vital for investors navigating Vietnam’s burgeoning financial landscape. With macroeconomic indicators continually evolving, staying informed facilitates wise investment choices. As demonstrated, local market dynamics and global economic trends hold substantial sway over the performance of HIBT bonds. Hence, investors are encouraged to closely monitor these factors while strategizing their investments. The landscape will likely evolve further, offering new opportunities to those adequately prepared.

For more insights and updates on cryptocurrency and bond investments, visit officialcryptonews.