Understanding HiBT Perpetual Swaps: A Comprehensive Overview for Traders

As digital trading platforms continue to evolve, traders are constantly on the lookout for innovative and efficient ways to maximize their trading strategies. In the world of cryptocurrencies, perpetual swaps have emerged as a notable financial instrument, capturing the interest of many trading enthusiasts. Specifically, HiBT perpetual swaps present unique opportunities within this context.

Consider this: In 2024 alone, over $4.1 billion was lost due to hacks in decentralized finance (DeFi) systems, highlighting the importance of secure and effective trading methods. Enter HiBT perpetual swaps—designed not only to protect investors but to exploit volatility in cryptocurrency markets.

This article will delve deep into the mechanics of HiBT perpetual swaps, their benefits, potential risks, and how they can impact your trading strategy in the growing Vietnamese crypto market, where user adoption has surged by over 50% in the past year.

What Are HiBT Perpetual Swaps?

HiBT perpetual swaps are innovative financial derivatives that allow traders to speculate on the future price of cryptocurrencies without an expiration date. Unlike traditional futures contracts, which have set expiration periods, perpetual swaps enable traders to hold positions indefinitely, provided they maintain adequate margin levels.

- Leverage: Traders using HiBT can amplify their exposure to the market through leverage, enabling them to take larger positions with a fraction of the capital.

- Price Tracking: Perpetual swaps are designed to closely track the spot price of an underlying asset.

- Funding Rates: To ensure that the price of the perpetual contract remains aligned with the underlying asset, periodic funding payments are exchanged between buyers and sellers.

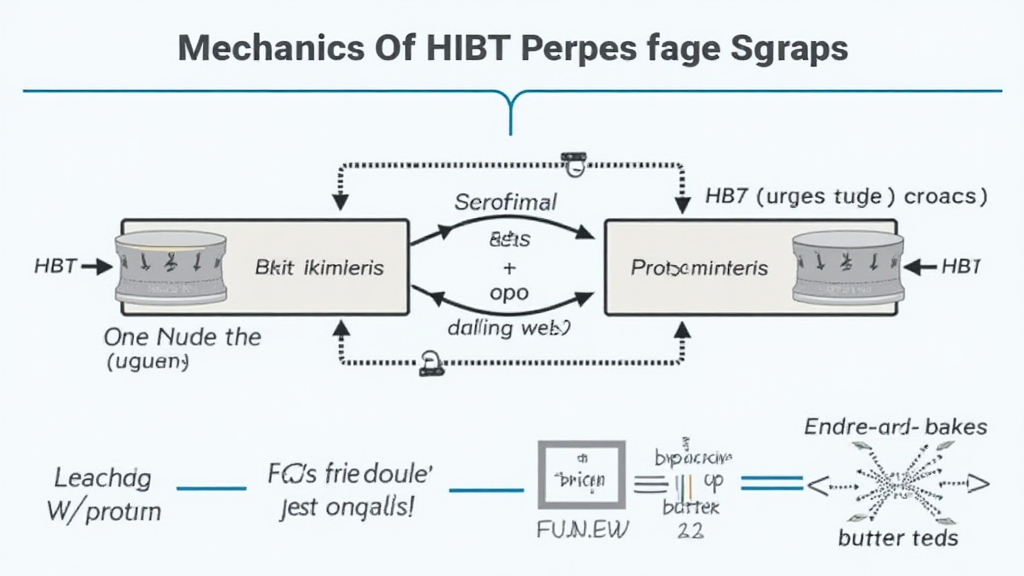

How Do HiBT Perpetual Swaps Work?

Let’s break it down further. The key components of HiBT perpetual swaps revolve around the mechanics of trading, including how pricing, margin, and funding rates interact. Learn how traders can skillfully navigate the complexities involved.

Pricing Mechanism

The pricing of HiBT perpetual swaps is determined by the underlying asset’s spot price. Yet a unique feature is the indexed price, which is a moving average of the spot price over a specific period. This mechanism protects against sudden price fluctuations.

Margin and Leverage

HiBT allows traders to use leverage up to 100x, meaning that with just $1, you can control $100 worth of an underlying asset. This high leverage magnifies both profits and losses.

Funding Rate Model

The funding rate is a periodic payment made between long and short traders. This rate helps maintain the balance between the perpetual contract price and the underlying asset price. A positive funding rate indicates that long positions must pay short positions, and vice versa. Understanding how this rate functions can significantly affect a trader’s profitability.

Benefits of HiBT Perpetual Swaps

Traders seeking to explore HiBT perpetual swaps can anticipate several advantages that make these instruments particularly attractive:

- No Expiration Dates: Hold positions as long as you wish, allowing you to capitalize on long-term market trends without the pressure of expiration.

- Flexibility: Trade a variety of cryptocurrencies with ease, enabling diversification in your portfolio.

- High Leverage: Maximize your potential gains by controlling larger positions with minimal capital outlay.

- Balanced Risk Management: Utilize stop-loss orders and other risk management strategies to mitigate your exposure.

Risks Involved with HiBT Perpetual Swaps

While the benefits are enticing, it’s crucial to understand the associated risks:

- Market Volatility: Rapid price movements can lead to liquidations, especially when using high leverage.

- Funding Payments: Depending on market dynamics, traders may face consistently high funding fees.

- Complexity: Understanding the intricacies of perpetual swaps requires aggressive learning and effective strategy development.

HiBT Perpetual Swaps in the Vietnamese Market

As mentioned earlier, Vietnam has seen a 50% year-over-year growth in cryptocurrency users, making it an important market for platforms like HiBT. This surge indicates a growing appetite for advanced trading options among local traders and investors.

User Growth Statistics

| Year | Users | Growth Rate (%) |

|---|---|---|

| 2022 | 2 million | – |

| 2023 | 3 million | 50% |

Source: Crypto Market Insights 2024

Conclusion: Are HiBT Perpetual Swaps Right for You?

The decision to engage with HiBT perpetual swaps comes down to individual trading goals, risk tolerance, and level of experience. For seasoned traders willing to navigate complexities, these financial derivatives can be a powerful tool. However, for novices, it’s advisable to pursue education and practice in a simulated environment.

Whether you’re in Vietnam, Japan, or anywhere else, understanding perpetual swaps adds a competitive advantage to your trading arsenal. Plus, with significant user growth in the Vietnamese crypto market, examining tools like HiBT can yield fruitful outcomes.

Be sure to consider the evolving landscape of cryptocurrency and engage in ongoing education to stay ahead of the curve. Remember, the world of cryptocurrency trading is as intricate as it is exhilarating.

For more insights into HiBT perpetual swaps and comprehensive resources on trading, visit hibt.com.