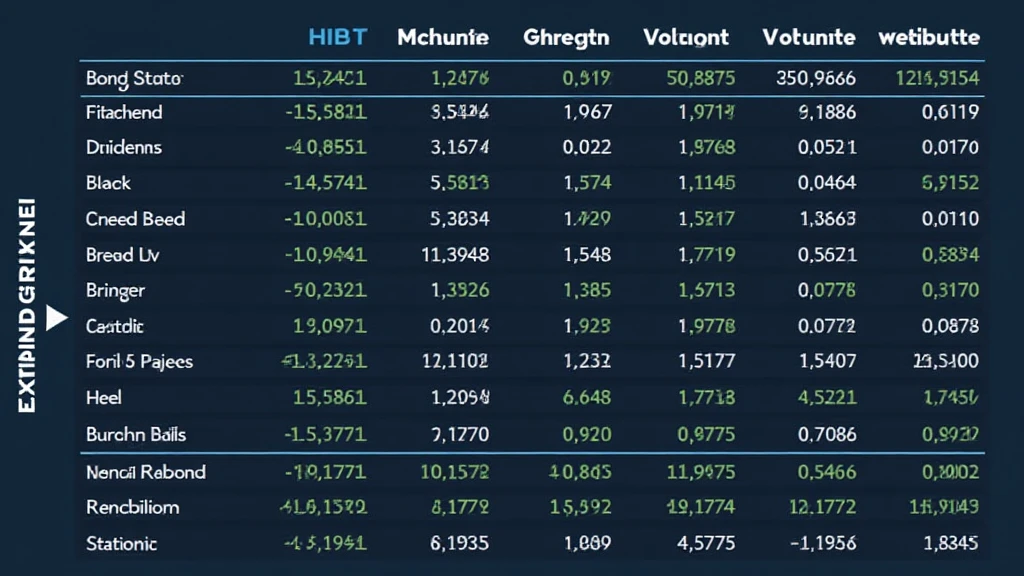

A Comprehensive Analysis of HIBT Bond Order Book Trends

With new innovations shaping the crypto landscape, traditional financial methods are being rigorously analyzed for their relevance. One such method is the HIBT bond order book, a sophisticated tool that is gaining traction in the crypto market. By leveraging this analysis, investors can gain valuable insights into market trends and make informed decisions.

Understanding the HIBT Bond Order Book

The HIBT bond order book provides a comprehensive view of a cryptocurrency’s trading activities, including buy and sell orders, their prices, and quantities. This information is pivotal for investors aiming to forecast market movements and refine their trading strategies.

What is an Order Book?

- An order book is a digital list of buy and sell orders for a specific asset.

- It displays the current interests of traders, providing insights into supply and demand.

- Order books can be dynamic, reflecting changes in trader sentiment as price movements occur.

Just like a bustling marketplace, the HIBT bond order book captures the essence of real-time trading activity, allowing participants to react swiftly.

The Importance of Order Book Analysis

Analyzing the order book helps traders understand price fluctuations and potential support or resistance levels.

Price Movements and Liquidity

- High volume on either side of the order book often indicates strong support or resistance.

- Liquidity is vital; assets with deeper order books are less susceptible to price manipulation.

- An investor can use the order book to identify potential entry and exit points.

For instance, if you see substantial buy wall formations in the HIBT order book, it could be an indicator of bullish sentiment.

The HIBT Market Landscape

Despite being a relatively new asset, the potential growth of HIBT in the Asian market, particularly in Vietnam, presents exciting prospects. According to recent studies, Vietnam’s crypto user growth rate surged by 42% in 2024, significantly impacting digital asset adoption.

Analyzing Market Sentiment

- Market sentiment can be extrapolated from the order book data.

- Systematic buying shows confidence, whereas extensive selling may indicate fear among investors.

- Understanding these patterns can aid strategic decision-making.

In essence, observing the HIBT bond order book might just be your key to deciphering the pulse of the market!

Practical Steps for Conducting HIBT Bond Order Book Analysis

As with any analytical approach, it’s essential to define your methods clearly. Here are some steps to get you started:

1. Setting Up a Trading Platform

- Choose a reputable exchange that offers HIBT trading.

- Familiarize yourself with the platform’s order book features.

2. Monitor Live Data

- Stay updated by analyzing real-time data feeds.

- Watch for immediate changes in buy and sell orders.

3. Compare Historical Data

- Identify past trends and patterns in the HIBT order book.

- Graph data for easier visual interpretation.

Potential Risks Involved

While HIBT bond order book analysis provides a wealth of insights, risk management remains paramount.

Volatility and Manipulation

- Be wary of potential price manipulation in thin order books.

- Understand market volatility and its effects on your predictions.

Investing in cryptocurrencies, much like any other asset class, necessitates a clear understanding of risks and a solid strategy to navigate them.

Conclusion

In summary, thorough HIBT bond order book analysis can significantly enhance your trading endeavors. By understanding the intricacies of the order book, market movements, and local trends, particularly in active markets like Vietnam, investors can gain a distinct advantage. Remember, energetic market players are often at the forefront of innovation—watch out for their movements!

As the digital landscape continues to evolve, adopting efficient analysis methods will be vital for sustained investments. Here’s to your journey through the fascinating world of HIBT bonds and their order book trends!

Not financial advice. Always consult local regulators before making investment decisions.