Bitcoin Technical Analysis: Mastering Trends and Insights

As the cryptocurrency market continues to evolve, Bitcoin technical analysis has become crucial for traders and investors who wish to navigate its complexities effectively. In 2024 alone, over $4.1 billion was lost due to various DeFi hacks, emphasizing the importance of informed trading decisions. But how can technical analysis empower you in this volatile landscape?

In this comprehensive guide, we will explore different aspects of Bitcoin technical analysis, dive into market trends, and equip you with valuable strategies to optimize your trading endeavors. Based on current data, Bitcoin remains a dominant force in the market. Are you ready to uncover insights that could help you capitalize on this ever-changing environment?

Understanding Bitcoin Technical Analysis

Bitcoin technical analysis (BTA) revolves around examining price movements and trading volumes to forecast future price changes. Think of it like predicting the weather; while it may not be 100% accurate, the closer your analysis aligns with real-time trends, the more reliable your predictions become.

- Price Charts: Employing various types of charts (line, bar, candlestick) assists in visualizing past movements.

- Indicators: Tools like the Relative Strength Index (RSI) and Moving Averages help identify patterns.

- Volume Analysis: Observing trading volume assists in understanding market sentiment.

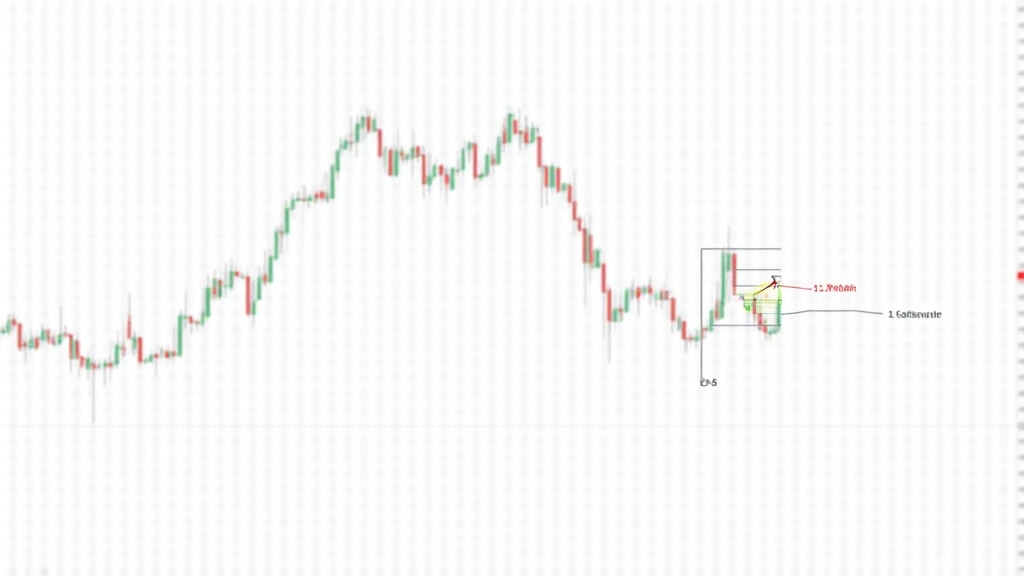

Importance of Candlestick Patterns

Candlestick patterns are an essential component of Bitcoin technical analysis. Each candlestick represents a specific period and illustrates the opening, closing, high, and low prices. Notably, there are several key patterns to watch for:

- Doji: Indicates indecision in the market.

- Hammer: Suggests a potential reversal from a downtrend.

- Engulfing Patterns: Indicates a possible change in trend direction.

Market Trends: Data-Driven Insights

As of 2025, Bitcoin has reached a market capitalization of approximately $1 trillion. In Vietnam, Bitcoin adoption has surged, with a 62% increase in active users within the past year. Here’s what you need to consider when assessing market trends:

- Price Volatility: Bitcoin prices can fluctuate dramatically, necessitating constant monitoring.

- Investor Sentiment: Social media and news headlines greatly influence market movements.

- Regulatory Developments: Legislation, particularly in emerging markets like Vietnam, shapes trading environments.

Using Technical Analysis to Your Advantage

So, how can you utilize technical analysis effectively? Here are some strategies:

- Set Clear Goals: Define your trading objectives and stick to your strategy.

- Risk Management: Use stop-loss orders to protect your investments.

- Back-testing: Test your strategies against historical data to gauge effectiveness.

Bitcoin and Altcoin Correlations

Understanding the relationships between Bitcoin and altcoins can greatly amplify your technical analysis strategies. For instance, when Bitcoin shows strong upward momentum, many altcoins tend to follow suit. Conversely, a significant drop in Bitcoin’s price often leads a downturn across the altcoin market.

- Market Dominance: Bitcoin usually commands a large market share, affecting altcoin prices.

- Technical Adjustments: Altcoins may adjust more rapidly to Bitcoin’s volatility.

Future of Bitcoin Technical Analysis

The future of Bitcoin technical analysis seems promising, with technological enhancements and data analytics poised to revolutionize trading strategies. Innovations like AI-driven algorithms can provide even more precise forecasts. Notably, according to Chainalysis 2025, advanced tools will enable traders to make data-backed decisions.

- Emerging Technologies: Innovations will make trading strategies more sophisticated.

- Increased Accessibility: More traders will have access to relevant tools and data.

Conclusion: Your Path to Successful Trading

In conclusion, mastering Bitcoin technical analysis is your pathway to making informed decisions in the fast-paced cryptocurrency environment. By leveraging various analytical tools and keeping up with market trends, you can enhance your trading success. Remember, just as in Vietnam’s blooming cryptocurrency market, staying ahead of the curve is crucial. Not financial advice; consult local regulators if needed.

For ongoing insights and updates on Bitcoin technical analysis, visit officialcryptonews.