Bitcoin Payment Terminal Solutions: Enhancing Merchant Acceptance

In a rapidly evolving digital economy, businesses are increasingly seeking ways to incorporate cryptocurrencies into their payment options. With $4.1 billion lost to DeFi hacks in 2024, security concerns have pushed for solutions that ensure integrity and reliability. Bitcoin payment terminal solutions emerge as a vital component, offering a secure and efficient way for merchants to accept cryptocurrency. Let’s dive into the landscape of these solutions, their benefits, and their role in the growth of cryptocurrency transactions.

The Rise of Bitcoin Payment Terminals

The growth of cryptocurrency usage, particularly Bitcoin, has seen a significant uptick in recent years. A survey revealed that over 45% of consumers are interested in using cryptocurrencies for daily transactions. This heightened interest drives businesses to adopt payment terminal solutions that support Bitcoin. But what does this mean for the retail landscape?

- Increased customer base: Accepting Bitcoin can attract tech-savvy consumers.

- Reduced transaction fees: Compared to traditional credit card transactions, Bitcoin fees can be lower.

- Fast transactions: Bitcoin transactions can occur almost instantly, providing a smoother checkout experience.

Understanding the Technology Behind Payment Terminals

Bitcoin payment terminals utilize blockchain technology, a decentralized ledger that offers transparency and security. Terminals can be hardware-based or software solutions, each with unique advantages. For instance, hardware terminals provide a tangible device for transactions, while software solutions can be integrated directly into existing point-of-sale systems.

Hardware vs. Software Terminals

Here’s a breakdown of their differences:

- Hardware Terminals: These are physical devices that accept Bitcoin payments. They are generally seen as more secure due to their offline functionalities.

- Software Solutions: Integrated into existing systems, software solutions allow merchants to process Bitcoin payments alongside traditional transactions.

For example, a Vietnamese coffee shop could use a hardware terminal to process customers’ Bitcoin payments while also managing their regular transactions through a software solution.

Benefits of Implementing Bitcoin Payment Terminals

Implementing Bitcoin payment solutions comes with several advantages for both merchants and consumers:

- Enhanced Security: With proper implementation of security protocols, Bitcoin transactions can be more secure than credit card payments, where chargebacks are a common issue.

- Access to New Markets: Emerging markets like Vietnam are witnessing a significant rise in cryptocurrency users, with reports indicating that 78% of Vietnamese internet users are familiar with cryptocurrencies.

- Brand Image: By adopting Bitcoin, businesses can position themselves as forward-thinking and innovative.

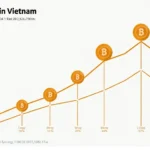

Navigating the Vietnamese Market

Vietnam represents a unique opportunity for Bitcoin payment terminal solutions. With a growing user base, businesses can leverage Bitcoin platforms to tap into this expanding market. According to recent data, the cryptocurrency adoption rate in Vietnam is one of the highest in Southeast Asia.

Challenges Facing Bitcoin Payment Terminals

Despite the advantages, there are challenges that merchants must navigate:

- Regulatory Uncertainty: Regulations around cryptocurrency are still developing, and businesses must ensure compliance with local laws.

- Market Volatility: Bitcoin’s price fluctuations can impact transaction values, which may deter some merchants from adopting this technology.

- Consumer Awareness: Many customers are still hesitant to use cryptocurrencies due to lack of understanding or trust.

Best Practices for Implementation

To successfully implement Bitcoin payment terminals, merchants should consider the following best practices:

- Choose the Right Provider: Select a payment terminal provider known for their security and reliability, such as CoinGate or BitPay.

- Train Your Staff: Provide thorough training to staff members on how to handle Bitcoin transactions.

- Educate Your Customers: Offer resources or FAQs to help customers understand the benefits of paying with Bitcoin.

Future Trends of Bitcoin Payment Solutions

As technology evolves, the future looks promising for Bitcoin payment terminal solutions. Here are some anticipated trends:

- Integration with Mobile Wallets: As mobile wallets grow in popularity, terminals will likely adapt to facilitate easy transactions.

- Enhanced Security Features: The integration of biometric authentication could further secure Bitcoin transactions.

- Smart Contracts and Payment Automation: Automation technologies will streamline transactions and reduce manual errors.

Looking ahead, according to Chainalysis 2025, there will be increased merchant adoption of cryptocurrencies, particularly in regions like Southeast Asia. This means businesses that embrace Bitcoin payment terminal solutions now will be well-positioned for future growth.

Conclusion

Bitcoin payment terminal solutions are shaping the future of commerce by providing secure, efficient, and innovative ways for merchants to accept cryptocurrencies. As the global crypto landscape continues to evolve, businesses must adapt to stay competitive. Whether it’s through hardware or software solutions, embracing Bitcoin payments can open new avenues for growth, especially in emerging markets like Vietnam.

In summary, adopting Bitcoin payment terminal solutions not only enhances transaction security but also increases consumer interest and market reach. As we move forward, the potential of these solutions will likely reshape the way we view payment systems altogether.

For more insights on cryptocurrency adoption in Vietnam and blockchain technology, visit hibt.com. Remember this is not financial advice; consult local regulators to understand compliance and regulations relevant to your business.

Written by Dr. Alex Tran, a blockchain expert with over 15 published papers on digital currencies and a contributor to various blockchain audits for recognized projects.