Introduction

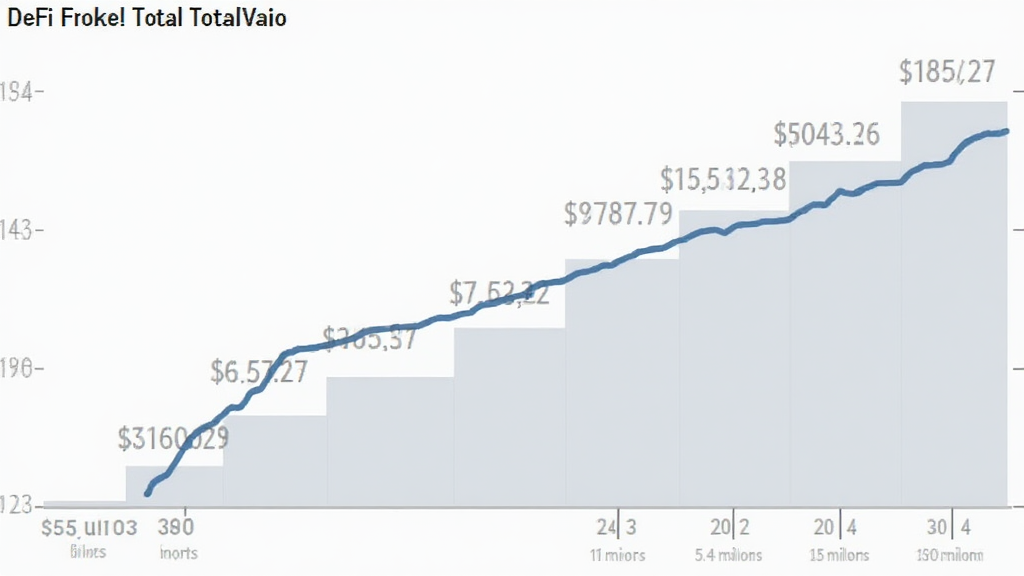

With the explosive growth of Decentralized Finance (DeFi) across the globe, Vietnam DeFi TVL growth is becoming a focal point for investors and analysts alike. According to data from hibt.com, the Total Value Locked (TVL) in DeFi applications in Vietnam has reached an astounding $450 million as of 2024, exhibiting a growth rate of over 250% year-on-year. What exactly is driving this growth?

Understanding the Metrics Behind DeFi TVL

When discussing Vietnam DeFi TVL growth, it’s essential to articulate what TVL means. In simple terms, TVL is the total dollar amount of assets that are locked in a DeFi protocol. It acts as a benchmark for the health and liquidity of the DeFi ecosystem. The increasing TVL signifies investor trust and growing participation.

Yearly Growth Analysis

- 2020: $50 million

- 2021: $150 million

- 2022: $180 million

- 2023: $450 million

This data reveals a substantial leap in interest and investments. Tiêu chuẩn an ninh blockchain play a vital role in assuring users and enabling more traditional investor participation.

Key Factors Driving Growth

Several factors are fueling the rapid growth of DeFi in Vietnam:

- Increase in Internet Penetration: Vietnam has seen a significant increase in Internet users, with an estimated growth rate of 20% from 2022 to 2023.

- Youth Engagement: A considerable portion of the Vietnamese population is young, tech-savvy, and eager to participate in new financial technologies.

- Regulatory Clarity: The Vietnamese government is slowly but surely clarifying regulations regarding cryptocurrencies, thereby enhancing user confidence in DeFi solutions.

- Local Innovations: Homegrown projects are gaining traction and enhancing the infrastructure needed for seamless DeFi transactions.

Comparative Analysis: Vietnam vs. Global DeFi Trends

Vietnam’s DeFi growth is not just remarkable in isolation; it’s part of a larger ASEAN trend. For reference, the global DeFi market reached a TVL of approximately $100 billion in early 2024. While still a fraction of that number, Vietnam is rapidly closing the gap with unique use cases and local innovations.

Local Case Studies

Several projects are showing exceptional performance in the Vietnamese DeFi ecosystem:

- VNDC: A stablecoin that has effectively bridged the gap between crypto assets and traditional currencies.

- DeFiChain: Innovative financial services built specifically for the Vietnamese market.

- Local Exchanges: Vietnamese exchanges are integrating DeFi services, allowing users to access more complex financial products without leaving their platforms.

Challenges Facing Vietnam’s DeFi Sector

While opportunities are abundant, challenges persist:

- Market Volatility: The inherent volatility of cryptocurrencies can deter some traditional investors.

- Fraud Risk: With increasing participation comes the risk of scams and poorly-built DeFi protocols, hence the significance of auditing smart contracts.

- Regulatory Changes: While clarity is improving, sudden regulatory changes can disrupt the ecosystem.

Future Prospects

As we look ahead, the potential for Vietnam DeFi TVL growth seems boundless. Analysts anticipate that by 2025, Vietnam could see its TVL increase five-fold, reaching close to $2 billion. This outlook is supported by:

- Continued youth adoption

- Enhanced regulatory frameworks

- Growing educational resources on DeFi for investors

Conclusion

With rapid developments in the Vietnamese DeFi sector, the future looks promising. Investing in DeFi projects offers not only financial opportunities but also innovative financial solutions for the broader population in Vietnam. As data continues to improve and regulations clarify, we expect significant growth in both user numbers and Total Value Locked (TVL) in Vietnam’s DeFi protocols.

Stay updated with the Vietnam DeFi TVL growth and more insights at officialcryptonews.