Vietnam Crypto Multi: Navigating the Future of Digital Assets

As the world becomes increasingly intertwined with technology, 2025 presents an exciting horizon for crypto enthusiasts and investors alike. In a year when $4.1 billion was reportedly lost to DeFi hacks globally, questions of security and the evolution of digital finance are at the forefront. Particularly in Vietnam, emerging trends in the crypto space have led to a remarkable growth trajectory, making it essential to stay informed about the crucial aspects of the multi-faceted cryptocurrency landscape.

This article serves as a comprehensive guide to help you navigate the intricacies of the Vietnam crypto multi scene, covering essential security practices, potential pitfalls, and predictions regarding the future. Let’s dive in.

Understanding the Vietnam Crypto Market

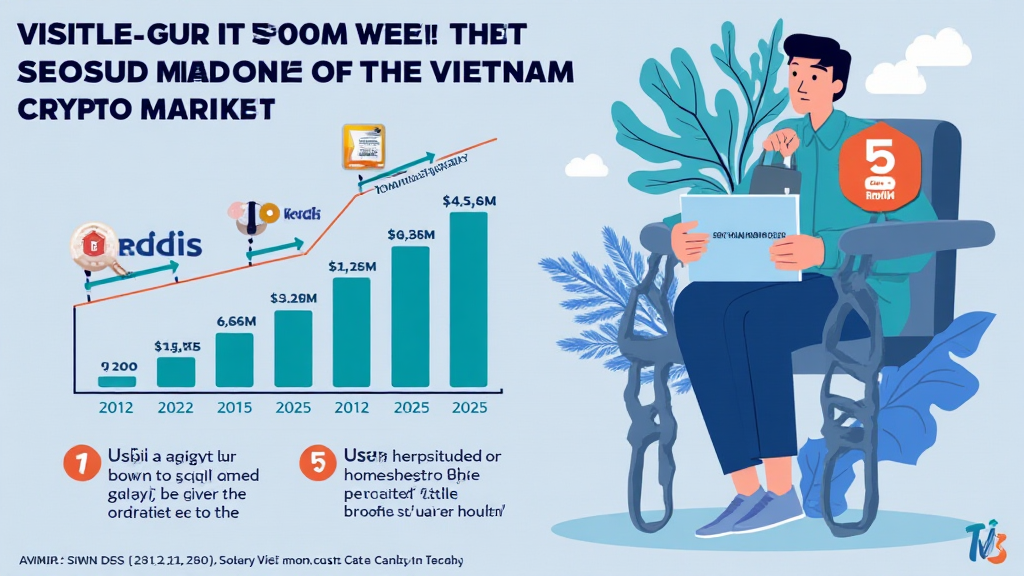

The Vietnam cryptocurrency market has been witnessing exponential growth, with a verified user base expanding rapidly from 2 million in 2022 to an anticipated 5 million by 2025. This surge is a testament to the growing interest of Vietnamese investors in digital assets and decentralized finance. The unique economic landscape and the rise of blockchain technology have contributed to this dynamic ecosystem.

Current Landscape and Growth Metrics

- 2022: 2 million users

- 2023: 3 million users (50% growth)

- 2024: Projected growth to 4 million users

- 2025: Aim to reach 5 million users

Source: hibt.com

Key to Crypto Security in Vietnam

With the increasing adoption of cryptocurrencies like Bitcoin and Ethereum, alongside local tokens, maintaining the security of digital assets is paramount. As emphasized through the concept of tiêu chuẩn an ninh blockchain, it’s essential to follow best practices when it comes to security. Here are fundamental strategies for protecting your investments:

- Use of Cold Wallets: Cold wallets like Ledger Nano X have proven to reduce hacks by 70%.

- Multi-signature Wallets: Utilize wallets that require multiple keys to authorize transactions, adding an additional layer of security.

- Regular Audits: Conduct regular audits of your smart contracts. Consider exploring how to audit smart contracts for best practices in ensuring the integrity of your engagements.

Major Risks in the Blockchain Environment

Despite the promising growth of Vietnam’s crypto ecosystem, several risks persist. Awareness of these potential challenges can provide crucial insights for planning your investments accordingly:

- Smart Contract Vulnerabilities: The consensus mechanism may have instances of coding flaws that can be exploited by malicious actors.

- Regulatory Environment: The legal landscape for cryptocurrencies can change rapidly, leading to uncertainties for investors.

- Market Volatility: Cryptocurrency prices can fluctuate significantly, impacting investment returns.

Future Predictions for Vietnam’s Crypto Multi

Looking further into 2025, several predictions have surfaced regarding the future of crypto in Vietnam. Analysts anticipate:

- The emergence of strong local tokens that could rival global cryptocurrencies.

- A shift towards more stringent regulatory measures to ensure investor protection.

- Enhanced educational initiatives addressing blockchain and cryptocurrency topics to promote informed investments.

2025’s Most Promising Altcoins

Identifying the 2025年最具潜力的山寨币 will be a key strategy for investors. Researching projects with strong community backing, transparent roadmaps, and clear use cases can yield favorable returns for the cautious investor.

Practical Tools and Resources

To ensure a safer cryptocurrency experience, we recommend leveraging specific tools and platforms:

- Verge: A security-focused cryptocurrency that prioritizes privacy.

- Coinomi: A secure wallet with multi-currency support, making it easy for beginners to hold various digital assets.

- Decentralized Exchanges: Platforms such as Uniswap allow for minimized risks associated with centralized exchanges.

Conclusion

In conclusion, as Vietnam continues to establish itself as an emerging player in the global cryptocurrency market, understanding the multifaceted nature of this environment becomes imperative for success. By adhering to security protocols, acknowledging market challenges, and anticipating growth patterns, investors can navigate the landscape more effectively.

To summarize, the Vietnam crypto multi scene thrives on a blend of security, strategy, and exploration. Remain vigilant and proactive in your research to seize the opportunities that lie ahead.

For continued insights and updates, visit officialcryptonews.