HIBT Stablecoin Bond vs Fiat Bond Returns for Vietnamese Investors

As we navigate the rapidly changing landscape of finance, many investors are weighing their options between traditional investments and the emerging world of digital assets. With recent figures indicating that the Vietnamese cryptocurrency market is seeing a growth rate of over 30% annually, many investors are looking for ways to optimize their portfolios. This brings us to an urgent question: **Should Vietnamese investors consider HIBT stablecoin bonds over traditional fiat bonds for better returns?**

The Appeal of Stablecoins in Vietnam

Stablecoins like HIBT are gaining traction in Vietnam. These digital currencies are designed to maintain a stable value relative to a fiat currency, making them less volatile than traditional cryptocurrencies. With the Vietnamese dong seeing fluctuating inflation rates, stablecoins present an attractive alternative.

- Stable value against fiat currencies

- Reduced volatility compared to traditional cryptocurrencies

- Increasing acceptance in commerce and investments

Market Trends: A Snapshot

The growth of cryptocurrency in Vietnam is mirrored in the rising number of digital wallets and exchange platforms. For instance, a recent report from Blockchain Research states that the number of crypto users in Vietnam increased to over 5 million in 2024, showcasing the nation’s burgeoning interest in digital assets.

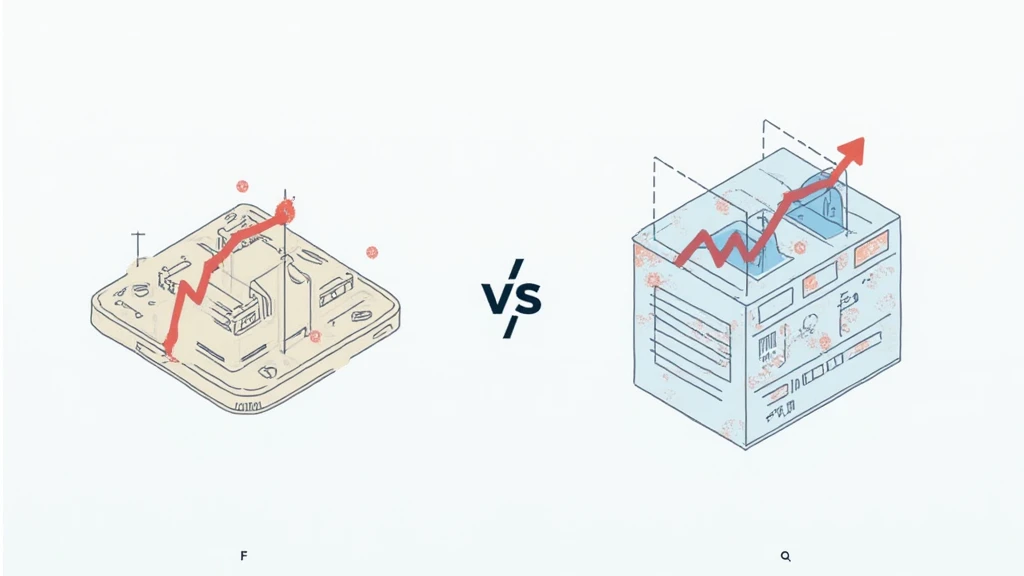

Understanding Bonds: HIBT vs Fiat

When it comes to investing, bonds have long been considered a stable choice. However, the introduction of stablecoin bonds like HIBT adds a new layer to this investment strategy:

- Fiat Bonds: Traditional bonds that are backed by government or corporate issuers, offering fixed returns over time.

- HIBT Stablecoin Bonds: A new breed of bonds issued in a stablecoin format, providing liquidity and accessibility to a digital-first investment.

Benefits of HIBT Stablecoin Bonds

Investors are increasingly drawn to HIBT bonds for various reasons:

- Higher potential returns due to favorable interest rates.

- Flexibility and ease of transaction in the digital realm.

- Transparency through blockchain technology, enhancing trust and accountability.

Comparing Returns: HIBT vs Fiat Bonds

To analyze returns, let’s break down the performance of HIBT bonds against fiat bonds:

| Investment Type | Average Annual Return (%) | Risk Level |

|---|---|---|

| Fiat Bonds | 3-5% | Low |

| HIBT Stablecoin Bonds | 8-12% | Medium |

As the table illustrates, HIBT bonds can offer significantly higher returns for Vietnamese investors willing to embrace a moderate level of risk. Alongside the financial benefits, investing in HIBT could provide a hedge against fiat inflation, especially in a volatile economic environment.

The Path Forward for Vietnamese Investors

So, how can Vietnamese investors approach this emerging opportunity? Here are some practical steps:

- Conduct thorough research on HIBT and other stablecoins.

- Consider investment diversification by including both fiat and HIBT bonds.

- Stay informed about the evolving regulatory landscape in Vietnam regarding cryptocurrencies and stablecoins.

Future Outlook: What Lies Ahead?

With projections indicating that Vietnam’s cryptocurrency market will exceed $1 billion by 2025, the potential for stablecoin investments like HIBT is promising.

Additionally, HIBT is poised to gain traction as more Vietnamese turn to stablecoins to secure their assets amid economic instability. This trend aligns with the global increase in digital asset adoption, emphasizing the need for investor education and awareness.

Conclusion: Which Bond Represents the Future?

As we’ve seen, HIBT stablecoin bonds provide a compelling alternative to traditional fiat bonds for Vietnamese investors in search of better returns and stability. With the right approach and understanding, investors can leverage this opportunity to enhance their investment portfolios effectively.

In summary, it’s all about understanding your risk tolerance, staying updated on market trends, and making informed financial decisions. Remember, investing in HIBT and similar instruments is not just about chasing higher returns; it’s also about securing your financial future in an unpredictable world.

For more insightful analysis and up-to-date information on cryptocurrency investments, visit officialcryptonews.

Author: Dr. Nguyen Van Anh, a leading expert in blockchain finance, has published over 20 articles on digital asset management and has led numerous audits on notable blockchain projects.