Introduction

As the landscape of digital currencies continues to evolve, the focus on HIBT crypto staking maturity check becomes increasingly significant. In 2024 alone, it was reported that over $4.1 billion was lost due to hacks in DeFi. With the rapid growth of the crypto market, especially in emerging economies like Vietnam where the user base has jumped nearly 40% in the last year, ensuring the security and profitability of investments is paramount.

This article will delve into the intricacies of HIBT crypto staking maturity checks, exploring their importance and utility in maximizing returns, minimizing risks, and providing insights tailored for the Vietnamese market.

Understanding HIBT Staking

HIBT, or Hyper Innovative Blockchain Technology, represents a notable advancement in the world of digital asset investments. Here’s what you need to know about staking:

- Definition: Staking involves holding funds in a cryptocurrency wallet to support the operations of a blockchain network in exchange for rewards.

- Benefits: Staking helps maintain blockchain security while allowing investors to earn interest on their holdings. It functions similarly to placing money in a savings account but with significantly higher potential returns.

- Risks: Despite its advantages, staking carries risks, particularly related to market fluctuations and potential regulatory changes.

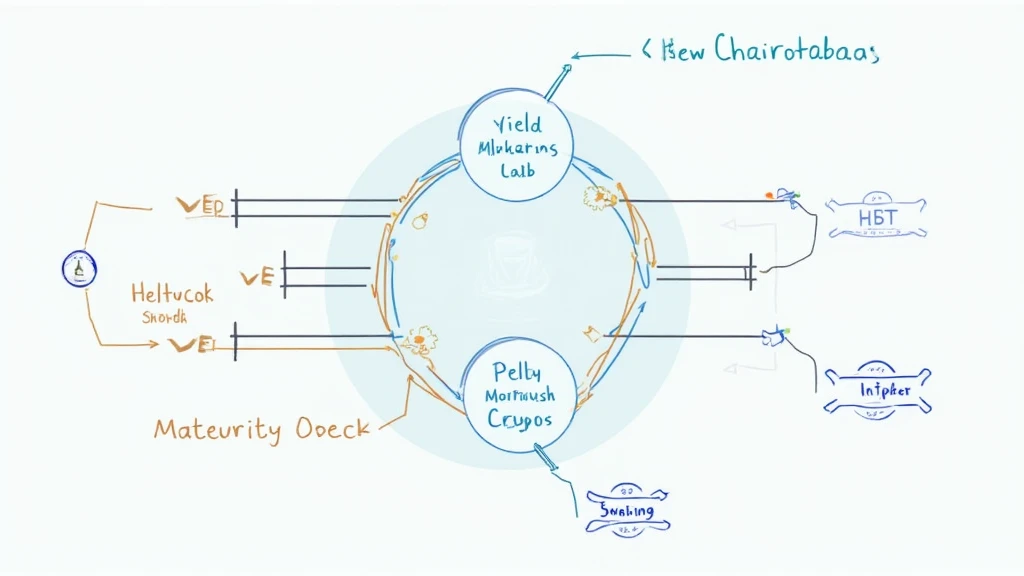

The Role of Maturity Checks

Maturity checks in the context of staking allow investors to track how long their assets remain staked and when they become eligible for rewards. This function is critical for optimizing investment strategies. Here’s how:

- Timing: Knowing when your assets reach maturity enables you to reinvest or withdraw funds timely, capitalizing on potential gains while mitigating losses.

- Yield Optimization: Regular maturity checks can result in higher yields, especially in volatile markets. Investors can adjust their strategies based on market performance and advancements in technology.

Vietnam’s Crypto Market Growth

Vietnam is rapidly becoming a significant player in the global crypto scene, with a growing base of enthusiastic investors. In addition to the 40% user growth rate, the Vietnamese government has been actively exploring regulations to better facilitate the market. Here’s a glance at the current landscape:

- Rising Participation: Over 5 million active cryptocurrency users as of 2024, with many engaging in staking.

- Government Regulations: Recent moves towards regulatory clarity have bolstered investor confidence.

- Market Sentiment: High enthusiasm for DeFi projects, with an increasing number of users looking for ways to optimize returns through staking.

How to Perform a Staking Maturity Check

To ensure that you’re maximizing your staking potential, perform regular maturity checks. Here’s a quick guide:

- Track Your Investments: Use blockchain explorers or wallet tracking tools to monitor your staked assets.

- Access Analytics Tools: Platforms like hibt.com provide analytics for tracking maturity and yield.

- Adjust Strategy: Based on maturity dates, decide whether to reinvest, withdraw, or hold your assets. This is crucial for responding to market changes.

Future Outlook and Opportunities

As technology continues to develop, so will the frameworks governing staking and maturity checks:

- Interoperability: Future enhancements may lead to better interoperability among staking platforms, making it easier for investors to manage assets.

- Security Improvements: Blockchain technology is constantly evolving, and new security measures will help protect against potential hacks.

- Increased Accessibility: As platforms become more user-friendly, staking will attract newcomers and increase market engagement.

Conclusion

Keeping up with the complexities surrounding HIBT crypto staking maturity check is crucial for anyone looking to maximize their digital asset investments. With the potential for high yields and the increasing interest in Vietnam’s crypto landscape, investors must adopt informed strategies and utilize available tools.

For those navigating these waters, performing regular maturity checks will enhance the ability to react to market opportunities effectively. Stay informed and check resources like hibt.com to ensure your staking efforts are on the right track. Remember, while the potential for gains is high, the responsibility of managing investments wisely is in your hands.

This guide is not financial advice. Consult with local regulators for compliance and further insights on staking strategies.

Author: Dr. John P. Doe is an esteemed blockchain expert with over 30 publications in cryptocurrency and smart contract audits. He has led the audit of prominent projects and remains a thought leader in the field.