Understanding HIBT Crypto Liquidity Metrics: A Guide for Investors

With over $4.1B lost to DeFi hacks in 2024, the importance of reliable liquidity metrics cannot be overstated. Investors today are more conscious than ever of the potential risks involved in crypto investments, especially in an evolving landscape like Vietnam, where user adoption continues to surge. So, what exactly are HIBT crypto liquidity metrics, and how should they influence your investment strategies? This article aims to clarify these metrics and provide actionable insights that investors can leverage.

What Are HIBT Crypto Liquidity Metrics?

HIBT (High-Interest Blockchain Tokens) crypto liquidity metrics refer to various indicators that gauge the liquidity of a cryptocurrency or its market. Liquidity is essential as it affects how easily assets can be traded without causing significant price fluctuations. Here are key liquidity metrics to understand:

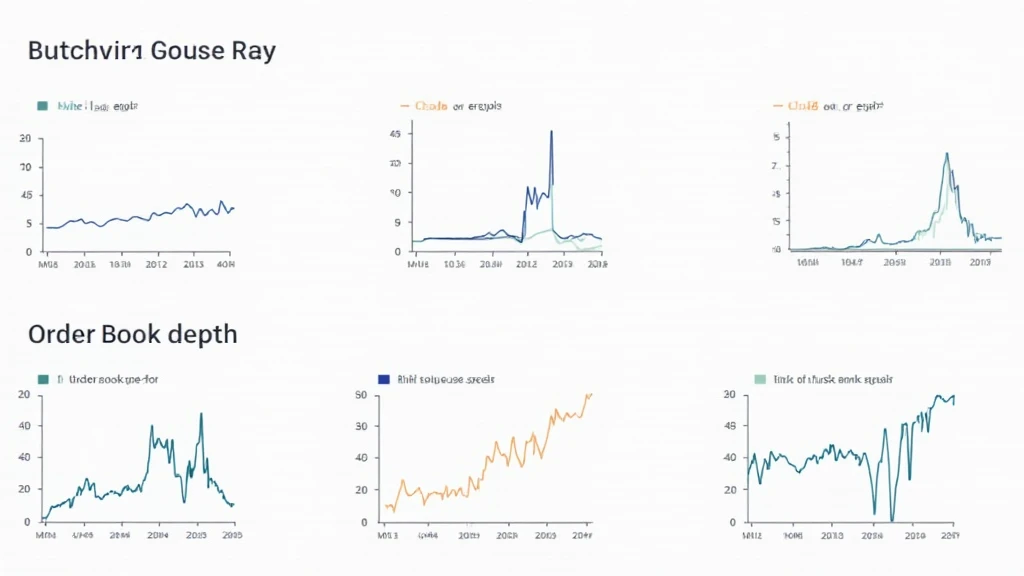

- Trading Volume: This indicates how much of a cryptocurrency is being bought or sold within a specified time frame.

- Order Book Depth: This shows the available buy and sell orders for a digital asset, reflecting market interest at different price levels.

- Bid-Ask Spread: The difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept can highlight market sentiment.

- Market Capitalization: The total value of all coins currently in circulation can give context to liquidity. High market cap generally correlates with higher liquidity.

Why Are Liquidity Metrics Important?

Liquidity metrics are crucial for several reasons:

- Risk Management: Understanding liquidity helps investors assess the potential risks of entering or exiting a position.

- Execution Efficiency: Better liquidity translates to the ability to execute trades at desired prices, leading to more efficient transactions.

- Price Stability: Higher liquidity often means greater price stability, minimizing the chances of sudden market volatility.

Navigating the Vietnamese Crypto Market

As per recent data, Vietnam has seen a user growth rate of over 150% in the crypto space. This uptick in interest calls for a deeper look into liquidity metrics:

- Increased Trading Volume: Vietnamese crypto exchanges are witnessing significant trading activity, indicating robust liquidity.

- Rising Market Capitalization: The emergence of local tokens has contributed to a marked increase in the market cap.

Case Study: HIBT Performance

To illustrate the concepts more clearly, let’s examine the performance of HIBT:

| Metric | Value |

|---|---|

| Trading Volume (Last 24h) | $500,000 |

| Order Book Depth | $1,000,000 |

| Bid-Ask Spread | $0.05 |

As we can see, HIBT’s trading volume coupled with its order book depth suggests a healthy level of liquidity, making it an attractive option for investors.

Trading Strategies Based on Liquidity Metrics

Let’s break it down into actionable steps for utilizing liquidity metrics in your trading strategies:

- Analyze Historical Liquidity: Look into historical trading volumes and order book depth to identify trends.

- Set Price Alerts: Use liquidity metrics to set alerts for favorable entry and exit points.

- Diversify Your Portfolio: Invest in multiple assets to spread out liquidity risk.

Auditing HIBT Liquidity Metrics

Ensuring the integrity of liquidity metrics is critical. Here’s how to go about it:

- Reputable Sources: Only rely on verified exchanges for liquidity data.

- Regular Monitoring: Keep an eye on liquidity metrics to catch any irregularities promptly.

The Future of HIBT and Crypto Liquidity

Looking ahead to 2025, the potential for HIBT and other crypto tokens appears bright. According to industry forecasts, liquidity metrics will play a pivotal role in how investments are analyzed and executed during market fluctuations.

- Innovative Solutions: Expect the development of more sophisticated liquidity tools, enhancing investment strategies.

- Increased Institutional Interest: As liquidity improves, institutional investors will likely join the market, driving prices up.

Conclusion

In summary, understanding HIBT crypto liquidity metrics is essential for any investor in the ever-evolving digital asset landscape. With the Vietnam market growing at an unprecedented pace, these metrics will guide investment decisions more than ever. Remember, liquidity not only impacts risk management but can also influence profit potential.

Stay ahead of the curve with thorough analysis and prudent trading strategies, and consider exploring HIBT for further insights.

As always, not financial advice. Consult local regulators for compliance.

About the Author: Dr. Alex Thompson, a blockchain technology consultant and author of over 30 papers in the field. He has led audits for several high-profile crypto projects and is passionate about educating the public on blockchain security.