Cryptocurrency Bond Market Analysis: Exploring Vietnam’s Digital Frontier

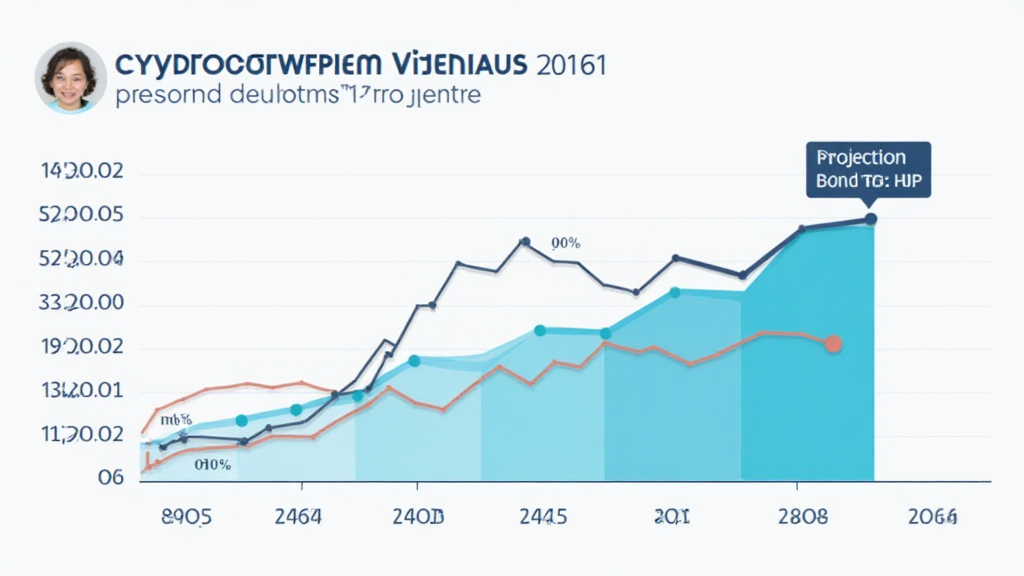

As global financial markets evolve, cryptocurrency is reshaping how we perceive value and investment. In 2024, Vietnam has witnessed a significant surge in interest in digital currencies, paving the way for the analysis of the cryptocurrency bond market.

According to recent reports, Vietnam’s cryptocurrency user base grew by 45% this year, a promising indicator for future investments. Vietnam’s unique position in Southeast Asia makes it a fertile ground for innovative financial solutions.

This article offers valuable insights into Vietnam’s cryptocurrency bond market, examining its potential and challenges. By understanding the local market dynamics, investors and stakeholders can make informed decisions.

Understanding the Cryptocurrency Bond Market

The cryptocurrency bond market combines traditional finance with blockchain technology. It allows businesses to issue bonds in the form of digital tokens, enabling faster transactions and broader access to capital.

Like a bank vault for digital assets, this new financing method is both secure and efficient. Vietnam’s evolving regulatory landscape supports this innovation.

The Mechanics of Cryptocurrency Bonds

Cryptocurrency bonds are digital representations of debt that can be traded on blockchain platforms. Investors purchase these bonds with cryptocurrencies, and in return, receive interest over a specified period.

- Efficiency: Transactions are faster due to the elimination of intermediaries.

- Global Access: Investors from around the world can participate, broadening the market.

- Enhanced Security: Blockchain‘s immutable nature reduces fraud risk.

Regulatory Landscape in Vietnam

The Vietnamese government is gradually adopting regulations related to cryptocurrencies. The Ministry of Finance has proposed several measures to govern the issuance of cryptocurrency bonds. Their aim is to ensure transparency and security for investors.

In Vietnam, these developments are crucial as they help drive trust in the cryptocurrency market. For instance, regulations regarding tiêu chuẩn an ninh blockchain must be established to protect investors.

Market Potential in Vietnam

Vietnam’s population is tech-savvy, with over 70% of people under 35 years old. This demographic is more inclined to explore digital currencies than older generations. Consequently, this is driving the demand for cryptocurrency bonds.

Furthermore, the emergence of local startups focusing on blockchain technology is set to enhance Vietnam’s cryptocurrency bond market. These startups are looking to bridge the gap between traditional finance and digital assets.

Challenges Facing the Market

Despite the prospects, several challenges hinder the growth of cryptocurrency bonds in Vietnam:

- Regulatory Uncertainty: The lack of clear laws can discourage investment.

- Market Volatility: Cryptocurrency values can fluctuate, impacting bond returns.

- Security Risks: While blockchain enhances security, vulnerabilities still exist.

How to Navigate the Cryptocurrency Bond Market

Investors looking to enter this nascent market should be well-prepared. Here’s how to navigate the cryptocurrency bond landscape in Vietnam:

- Research Projects: Look for reputable projects with transparent roadmaps.

- Diversify Investments: Don’t put all funds in one bond; spread risk.

- Stay Informed: Keep up with market trends and regulatory changes.

Real-World Case Studies

Several Vietnamese startups are pioneering the issuance of cryptocurrency bonds. For example, HIBT successfully launched a bond token last year, raising significant capital for expansion.

This case exemplifies the possibilities within the cryptocurrency bond market and offers a blueprint for future projects.

Conclusion: A Bright Future Ahead

As Vietnam continues to embrace digital currencies, the cryptocurrency bond market shows great promise. With regulatory advancements and growing interest among investors, Vietnam could become a leader in the cryptocurrency bond landscape.

Investors should watch closely. As the market matures, more opportunities will emerge for innovative financing solutions, helping businesses grow while providing returns for investors.

In summary, Vietnam’s cryptocurrency bond market analysis reveals a flourishing ecosystem filled with potential risks and rewards. By focusing on the challenges and opportunities, stakeholders will be well-positioned to thrive in this digital frontier.

For more insights and updates on cryptocurrency trends, visit officialcryptonews.