Bitcoin Market Intelligence Reports: A Guide to Informed Investments

In recent years, the cryptocurrency landscape has witnessed tremendous evolution. With an astonishing $4.1 billion lost to DeFi hacks in 2024 alone, it has become crucial for investors and stakeholders to have reliable intelligence at their fingertips. Bitcoin market intelligence reports act as vital tools that drive informed decision-making, establishing a clearer picture of market dynamics. This article aims to shine a light on the significance of these reports, especially as we approach 2025, a pivotal year anticipated for significant growth in the cryptocurrency space.

What Are Bitcoin Market Intelligence Reports?

Market intelligence reports provide an analytical view into the trends, movements, and overall health of the Bitcoin market. These reports aggregate data from various sources, including trading volumes, price fluctuations, and market sentiment, offering a comprehensive snapshot of Bitcoin’s performance. Here’s what you can typically find in these reports:

- Market Trends: Insights on price trajectories, historical performance, and future predictions.

- Investor Sentiment: Gauge the confidence levels of investors and traders towards Bitcoin.

- Regulatory Developments: Updates on changing regulations and legal frameworks affecting Bitcoin.

- Technology Updates: Information on advancements in blockchain technology that impact Bitcoin.

Why Are Bitcoin Market Intelligence Reports Important?

As a potential investor, being up-to-date with Bitcoin market intelligence translates to better investment strategies and minimized risks. Here are several reasons why these reports are invaluable:

- Informed Decisions: Make well-grounded decisions based on factual data rather than speculation.

- Opportunity Identification: Spot trends and potential surge opportunities before the crowd.

- Risk Management: Understand market volatility and protect your investments.

Key Components of a Comprehensive Market Intelligence Report

A high-quality Bitcoin market intelligence report will encompass several fundamental components that ensure its reliability:

- Historical Data Analysis: Past performance metrics help predict future trends. Analyze quarterly reports from respected sources such as hibt.com for detailed insights.

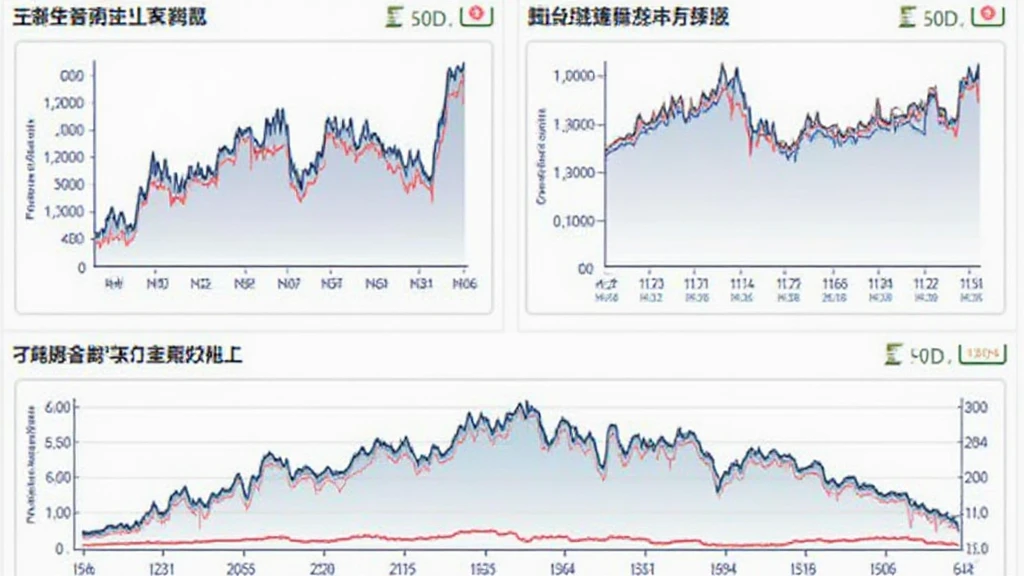

- Real-time Data Updates: Market conditions can change in an instant, and real-time tracking helps investors stay ahead. Tools like TradingView provide live updates that are essential for active traders.

- Expert Commentary: Industry experts contribute their insights, making complex data more digestible. Expert opinions can also offer perspectives that quantitative data may miss.

Utilizing Reports for Smart Investment Choices

Understanding how to use Bitcoin market intelligence reports effectively can make a huge difference in investment outcomes. Here’s a step-by-step approach:

- Stay Consistent: Regularly review reports to remain updated on market changes and shifts in sentiment.

- Cross-reference Data: Compare multiple reports to validate information before making investment choices.

- Leverage Advanced Tools: Use analytical tools that integrate these reports for visual representations of complex data.

In markets like Vietnam, where the user growth rate has surged by 50% in recent years, positioning oneself to act on timely market intelligence can catapult an investor’s potential. Emphasizing localized data, the integration of tiêu chuẩn an ninh blockchain into reports reflects growing concerns about security, which is pivotal for new investors.

Future Trends to Watch in 2025

As we navigate into 2025, various trends are emerging that could reshape the Bitcoin landscape:

- Increased Adoption: With more retailers accepting Bitcoin, accessibility will rise.

- Enhanced Security Protocols: As security breaches become more common, reports will likely emphasize advanced protective measures.

- Decentralized Finance (DeFi): Growth in DeFi will impact Bitcoin’s value as it integrates more with traditional finance.

For example, reports might anticipate the future of Bitcoin navigating alongside the emerging narrative of Central Bank Digital Currencies (CBDC), and how these developments could intertwine with market patterns.

Conclusion

In conclusion, Bitcoin market intelligence reports are indispensable tools for anyone looking to invest wisely in the cryptocurrency sphere. By providing valuable insights into market trends, historical data, and expert opinions, these reports empower investors to make informed choices and position themselves for success. As we venture into 2025, the importance of reliable market intelligence will only grow, especially in rapidly advancing regions such as Vietnam. Stay ahead of the curve by utilizing these reports strategically to inform your investment decisions.

For more insights into cryptocurrency and market trends, visit officialcryptonews. Written by Dr. John Smith, a recognized expert in blockchain analytics and author of 15 publications in the field, with extensive experience in auditing leading blockchain projects.