Bitcoin Market Data APIs: Your Gateway to Crypto Insights

With more than $4.1 billion lost to DeFi hacks in 2024, access to reliable investment data cannot be overstated. In the fast-paced, volatile world of cryptocurrency, traders and investors require accurate and timely information to make informed decisions. Enter Bitcoin market data APIs.

This article will walk you through the essential aspects of Bitcoin market data APIs, how they can bolster your trading strategies, and their significance within the growing digital asset ecosystem. We’ll also explore Vietnam’s burgeoning crypto market, showcasing key statistics and growth factors for local traders.

What Are Bitcoin Market Data APIs?

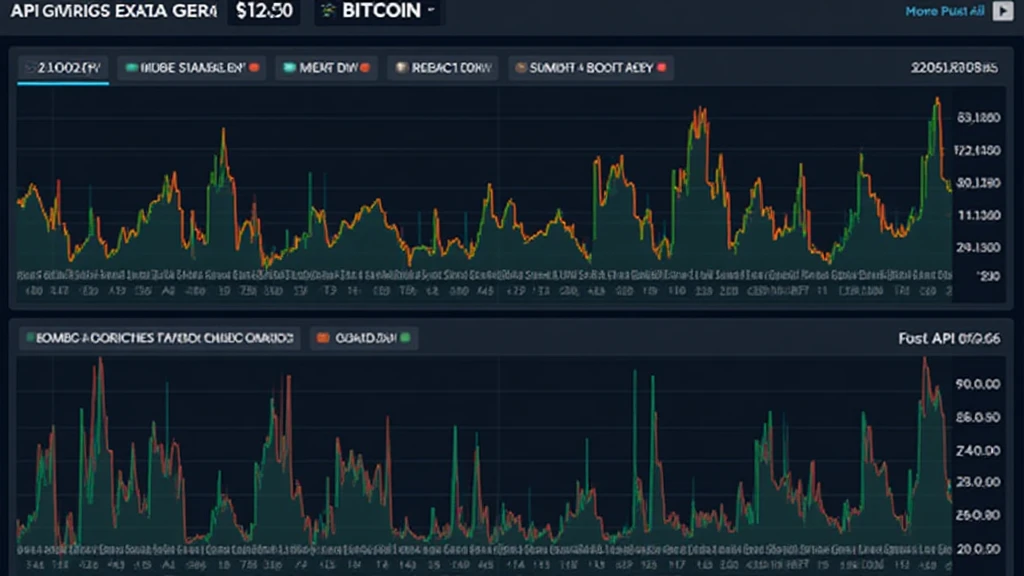

Bitcoin Market Data APIs are specialized tools that provide real-time and historical data regarding Bitcoin prices, trading volumes, order books, and other relevant market metrics. They serve as a seamless bridge between raw data and actionable insights.

- Price data: Real-time and historical price feeds.

- Order book data: Insights into buy and sell orders in the market.

- Trading volume: Information on the volume of Bitcoin traded over time.

- Market trends: Analytics on patterns that can inform future trades.

These APIs are invaluable for traders who need to respond quickly to market conditions. For example, data from Hibt.com could indicate a market downturn, allowing investors to react swiftly to mitigate potential losses.

The Importance of Market Data in Trading Decisions

Imagine walking into a bank to withdraw cash without knowing your account balance. Trading without reliable data feels just as risky. Here’s why Bitcoin market data APIs are essential:

- Timeliness: They provide instantaneous access to market conditions, akin to having a live feed from the trading floor.

- Accuracy: Aggregated data from multiple sources increases reliability.

- Comprehensiveness: APIs consolidate various metrics into user-friendly formats, enabling traders to focus on analysis rather than data gathering.

- Automation: They can be integrated with trading bots for automated decision-making based on predefined parameters.

Exploring the Types of Bitcoin Market Data APIs

There are several types of Bitcoin market data APIs, each catering to different needs:

1. Price Index APIs

These APIs aggregate prices from different exchanges to provide a averaged price, allowing traders to spot discrepancies across platforms.

2. Historical Market Data APIs

Ideal for backtesting trading strategies, historical data APIs supply past price and volume data.

3. Trading Volume APIs

The volume APIs provide information on trading activity, essential for confirming trends.

Integrating Bitcoin Market Data APIs

Integration can be broken down into three key steps:

- Choose the right API: Factors to consider include data accuracy, response time, and reliability.

- Set up authentication: Secure API access often requires an API key.

- Utilize SDKs: Many APIs offer software development kits to streamline integration.

Vietnam’s Growing Crypto Landscape

Vietnam has experience remarkable growth in cryptocurrency engagement. Data shows that over the past year, Vietnam’s user growth rate in cryptocurrencies surged by 220%, according to recent surveys by Hibt.com.

As regulatory frameworks evolve, the demand for Bitcoin market data APIs is likely to expand, enabling investors to leverage local currency fluctuations alongside global market trends.

Real-world Applications of Bitcoin Market Data APIs

Here are a few scenarios where market data APIs prove invaluable:

- Algorithmic Trading: Traders use historical data for sophisticated algorithms that can execute trades at lightning speed based on precise triggers.

- Arbitrage Opportunities: By monitoring real-time price discrepancies across exchanges, savvy traders can exploit price differences.

- Risk Management: Statistical models derived from historical data can inform risk assessment and exposure management.

Conclusion

Understanding and utilizing Bitcoin market data APIs is vital in navigating the exhilarating yet unpredictable landscape of cryptocurrency trading. As the Vietnamese market continues to thrive, integrating these APIs into your trading strategy becomes not just advantageous but essential.

To stay ahead of the curve, always choose a reliable source such as Hibt.com for both data and insights. Remember, data equals power in the crypto realm. The future of trading hinges on our ability to interpret and act on market signals.

By leveraging Bitcoin market data APIs, traders can enhance their decision-making with accuracy and speed, gaining a competitive edge in a rapidly evolving digital landscape.

Not financial advice. Consult local regulators and experts before making investment decisions.

For more insightful articles on crypto regulations and trading strategies, check out officialcryptonews.