Navigating the Bitcoin Market Cycle Prediction

In a world where Bitcoin represents over 60% of the cryptocurrency market capitalization, understanding the market cycle is crucial for both new and seasoned investors. According to a 2023 report from CoinMarketCap, Bitcoin’s volatility has led to significant price swings, making it essential to predict where we stand in its market cycle. This article sheds light on Bitcoin market cycle predictions, exploring analytics, historical data, and future trends.

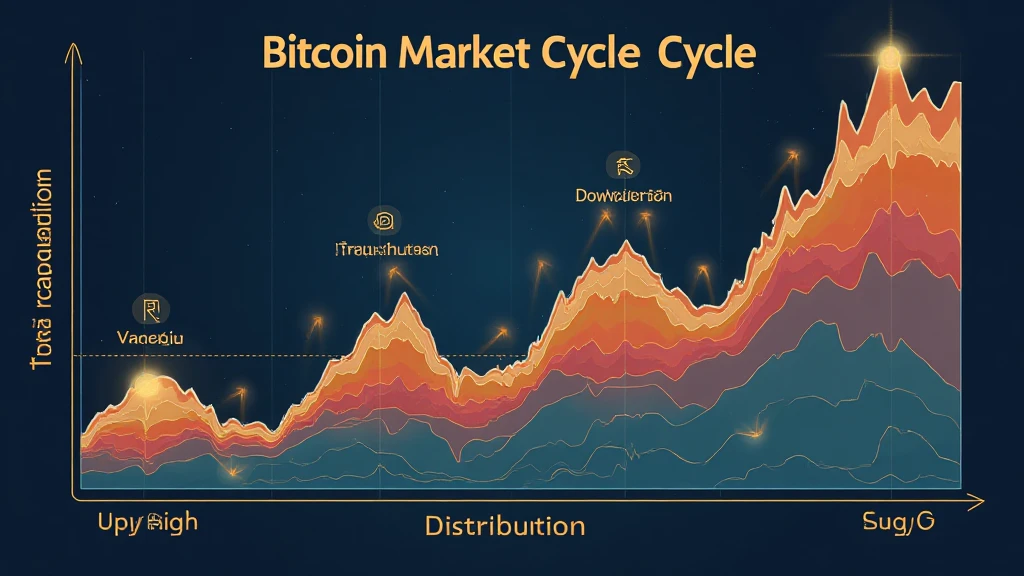

Understanding Bitcoin Market Cycles

The Bitcoin market goes through distinct phases: accumulation, upswing, distribution, and downturn. Let’s break this down:

- Accumulation Phase: Investors buy Bitcoin at lower prices, expecting a rise.

- Upswing Phase: Bitcoin price starts growing, attracting media attention and new investors.

- Distribution Phase: Early investors start selling for profits.

- Downturn Phase: Prices fall as market sentiment shifts and panic selling occurs.

Historical Data Insights

Historical data indicates that these cycles have been repeated since Bitcoin’s inception. For example, in late 2017, the price skyrocketed close to $20,000 due to a massive influx of new investors, only to crash sharply in early 2018.

Thus, analyzing past behavior helps set expectations for future movements. A study by Glassnode in 2022 referenced earlier cycles, showing that Bitcoin has typically experienced price corrections averaging around 80%, following major bull runs. Understanding these patterns allows investors to anticipate potential retracements.

What Influences the Bitcoin Market Cycle?

Several factors contribute to the dynamics of the Bitcoin market cycle, including:

- Market Sentiment: Positive news fosters investment, while negative events create panic.

- Regulatory Changes: Government decisions can significantly impact prices and investor behavior.

- Technological Developments: Innovations in blockchain technology can enhance Bitcoin’s utility, influencing price.

The Role of Institutional Investors

Increasing interest from institutional investors adds another layer of complexity. A report in early 2023 indicated that institutional investments grew by 35% in Vietnam, emphasizing the rise of Bitcoin adoption in emerging markets.

Vietnam’s Growing Crypto Landscape

In Vietnam, the user growth rate in cryptocurrency has surged 200% annually, according to data from Statista. This growing demographic is likely to affect market trends as new participants engage.

Predictions for 2024 and Beyond

Industry experts are predicting a continuation of these cycles, with many analysts eyeing the next halving event in 2024 as a potential trigger for upward momentum. Historical charts suggest that Bitcoin’s price tends to increase substantially after each halving.

- The 2024 halving is expected to lead to a supply shock.

- Many analysts forecast prices reaching between $100,000 and $200,000 by 2025.

Preparing for the Next Cycle

Understanding the Bitcoin market cycle can empower investors to make informed decisions. Here are some tips:

- Conduct thorough research on price history and predicted trends.

- Know when to enter and exit the market based on psychological factors.

- Leverage tools like dollar-cost averaging to minimize risks.

Conclusion: Positioning Yourself for Future Success

The Bitcoin market cycle remains an unpredictably fascinating area, with each phase providing opportunities and risks. As we anticipate the effects of upcoming events like the 2024 halving and continued institutional interest, having a solid grasp on market cycles will undoubtedly serve investors well. Bitcoin market cycle predictions will continue to play a pivotal role in investment strategies as they adapt to new developments.

For more insights into cryptocurrencies and investment opportunities, be sure to visit officialcryptonews.