Understanding HIBT Vietnam Bond MACD Crossover Entry/Exit Points

In today’s fast-paced financial landscape, traders and investors are constantly seeking rigorous and efficient methods to maximize their returns. The cryptocurrency market, in particular, offers myriad opportunities, but it also comes with its fair share of risks. With reports mentioning that over $4.1 billion was lost to DeFi hacks in 2024, it’s imperative to stay ahead of the curve. One potential strategy that can help traders is the MACD Crossover, especially relating it to the HIBT Vietnam bond market.

What is the MACD Indicator?

The Moving Average Convergence Divergence (MACD) is a widely used technical analysis indicator that aids in understanding price trends and momentum in the market. It consists of two moving averages—a fast line (the MACD line) and a slow line (the signal line)—which traders watch closely for crossover points. Here’s how it works:

- MACD Line: This is the difference between the 12-day and 26-day exponential moving averages (EMA).

- Signal Line: Typically a 9-day EMA of the MACD line.

- Zero Line: It’s essential for evaluating the overall direction of momentum.

Why Use MACD in the HIBT Vietnam Bond Market?

Hanoi Infrastructure Bond Trading (HIBT) is becoming increasingly relevant as Vietnam’s economy booms. Investors are looking at bonds not just for their stability but also for their potential returns. Using MACD with HIBT bonds can provide traders with insights into entry and exit points that are crucial for maximizing their investment.

In Vietnam, the user growth rate in the cryptocurrency sector has been remarkable, with projections indicating a rise by 30% in 2025. Thus, integrating traditional bond trading with crypto analytics allows for evolving strategies in investments.

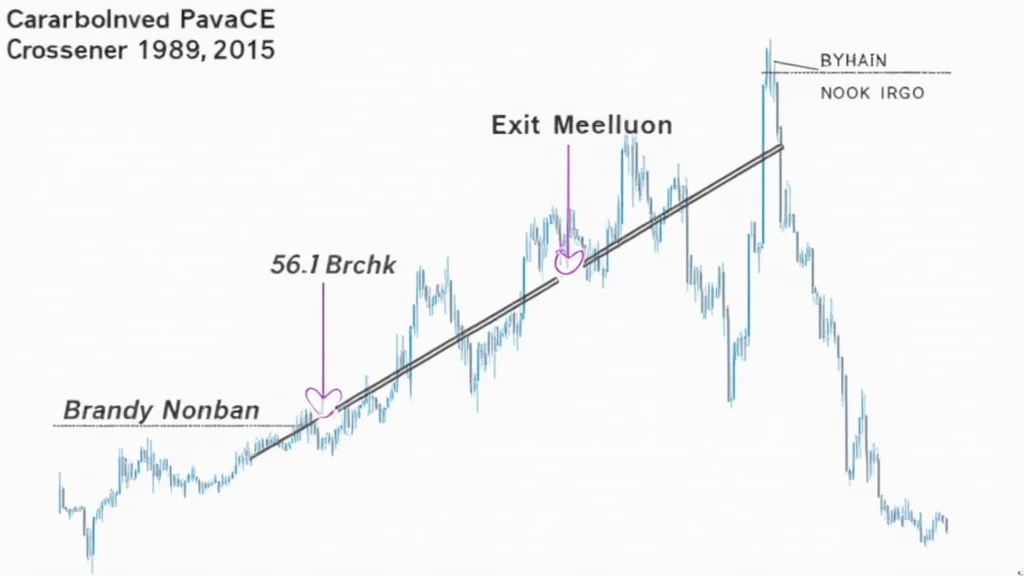

Identifying Entry Points with MACD Crossover

Let’s break down how one can identify entry points using the MACD crossover with HIBT bonds:

- Analyzing the Crossover: An entry signal occurs when the MACD line crosses above the signal line, indicating potential bullish momentum.

- Confirming with Other Indicators: While MACD is powerful, combining it with other indicators like Relative Strength Index (RSI) can provide stronger signals.

- Market Context: Reviewing macroeconomic conditions that may impact interest rates or inflation is critical when trading bonds.

Using MACD for Exit Points

Just as entering a trade is vital, knowing when to exit is equally important. Here’s how MACD can signal exit points:

- Bearish Divergence: If the price is making new highs but the MACD is making lower highs, it may indicate a weakening trend, suggesting an exit opportunity.

- Cross Below the Signal Line: This crossover typically serves as a signal to sell, especially if combined with other bearish indicators.

Real-World Example of MACD Crossover in Vietnam’s Bond Market

Suppose the HIBT bond price shows a MACD crossover where the MACD line crosses above the signal line during a bullish trend period in 2023. You can look at historical data:

| Month | Bonds Prices | MACD Signal |

|---|---|---|

| January 2023 | 25,000 VND | Positive Crossover |

| March 2023 | 30,000 VND | Negative Divergence |

In this case, a trader entering in January would benefit from the trend until signs of divergence appeared in March.

Combining Fundamental And Technical Analysis

While MACD provides a technical framework, understanding the fundamental aspects of HIBT bonds ensures comprehensive trading strategies:

- Interest Rate Trends: Monitor fluctuations in domestic and international rates, as they significantly affect bond valuations.

- Political Environment: Vietnam’s regulatory landscape can impact both HIBT bonds and the broader cryptocurrency market.

- Market Sentiment: Use news, social media, and economic data to gauge market psychology.

Localizing For the Vietnamese Market

In understanding the HIBT bond MACD Crossover in Vietnamese culture, context plays a pivotal role in strategy effectiveness. For instance, the term “tiêu chuẩn an ninh blockchain” correlates closely with how privacy, security, and transparency are perceived by the Vietnamese populace. Bond prices can be influenced drastically by local sentiment on blockchain and cryptocurrency technologies.

As reported by recent studies, Vietnam accounts for over 35% of the Southeast Asian cryptocurrency user base, and this growing engagement reflects in the increasing demand for related financial products, including bonds.

Challenges and Risks of Using MACD in Trading

No strategy is without its pitfalls. Here are the nuances of relying on MACD signals:

- Lagging Indicator: MACD is a lagging indicator; by the time the crossover signal occurs, you might have missed optimal entry/exit timing.

- False Signals: In volatile markets, traders might find themselves responding to false signals, leading to potential losses.

- Market News Impact: Significant news releases can quickly alter market dynamics, negating technical indicators.

Thus, it’s advisable to use MACD in conjunction with other analyses, safeguarding against the challenges of reliance on any single methodology.

Practical Tools for Enhanced Trading Strategy

For users wanting to improve their trading efficiency, here are practical tools:

- TradingView: A widely used tool allowing traders to customize their charts and set alerts based on MACD signals.

- CoinMarketCap: Tracks historical bond prices and generates insights based on prevailing trends.

- Ledger Nano X: This device maximizes security for crypto portfolios, reducing hacks by over 70%.

Conclusion

In conclusion, understanding the HIBT Vietnam bond MACD crossover can significantly enhance a trader’s ability to identify entry and exit points in a fluctuating market. Combining both technical analysis and fundamental insights creates a robust investment strategy. With the cryptocurrency user base rapidly expanding in Vietnam, ensuring proficiency with trading tools and techniques is vital for capitalizing on investment opportunities.

If you wish to delve deeper into cryptocurrency trends, market dynamics, or regulation, visit hibt.com.

Author: Dr. Nguyen Minh Tu, a financial analyst with over 15 published papers on investment strategies and a leading consultant for several high-profile blockchain projects.