Introduction: The Growing Landscape of Cryptocurrency Trading

With the surge in digital asset adoption, Vietnam is witnessing significant growth in blockchain technology. In fact, the Vietnamese blockchain market is projected to grow by over 30% in the next year alone. This increase is driven by the rising number of users engaging with cryptocurrency trading platforms, from 1 million users in 2020 to 4 million users in 2023. Given this backdrop, understanding trading platforms and their execution speeds has become crucial for traders.

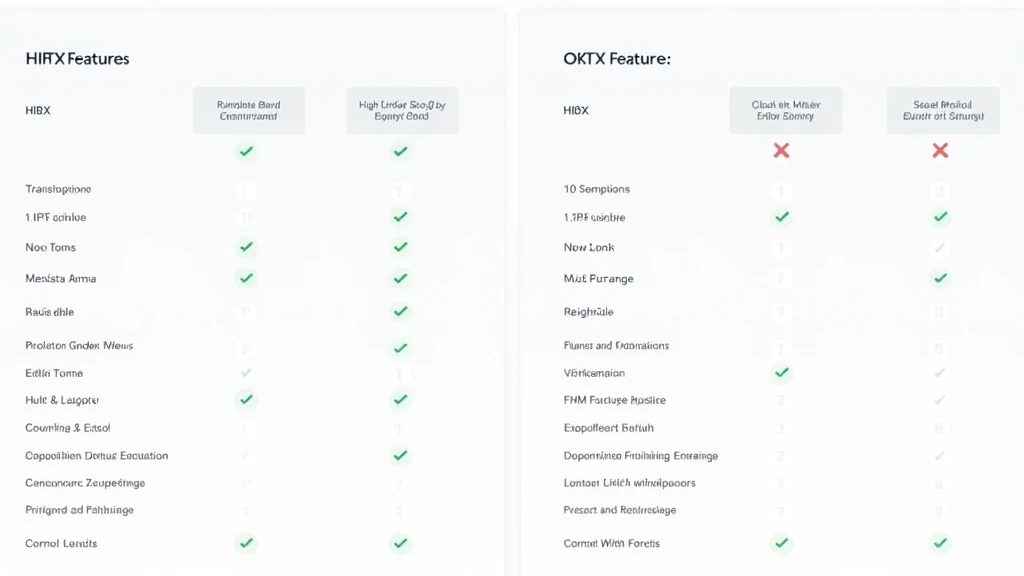

One key aspect that traders consider is the bond order execution speed of different platforms. In this article, we will analyze two popular crypto trading platforms, HIBT and OKX, focusing on their bond order execution speeds. By evaluating these platforms, traders can make informed decisions that may significantly impact their trading strategies.

Understanding Bond Order Execution Speed

Order execution speed is pivotal in the fast-paced world of cryptocurrency trading. The faster the execution, the better the chances of realizing profitable trades. Bond orders, which are crucial for long-term investments, also require support from platforms capable of executing trades promptly.

Here’s the catch: even a minor delay in execution can mean a massive difference in returns, especially in volatile markets. This is where platforms like HIBT and OKX stand out. But how do they compare in terms of speed? Let’s break it down.

HIBT’s Approach to Bond Order Execution

HIBT has invested in robust infrastructure to ensure high-speed execution of bond orders. This includes leveraging advanced algorithms and optimizing their order book strategies to minimize latency. The platform claims a bond order execution speed of under 50 milliseconds, which is impressive in the crypto landscape.

Furthermore, HIBT employs a tiered service structure, where traders can access faster execution speeds according to their trading volume and loyalty status. For instance, high-volume traders benefit from prioritized order execution.

OKX: Speed and Efficiency in Cryptocurrency Trading

On the other hand, OKX is known for its innovative technology stack that guarantees swift execution of trades. According to recent benchmarks, OKX achieves an execution speed close to 20 milliseconds. This speed is largely attributed to their global server network, which minimizes latency through geolocation-based routing.

Moreover, OKX features an integrated trading engine that allows for high-frequency trading (HFT), benefiting traders who are involved in short-term trades and quick entries and exits.

Comparative Analysis: HIBT vs. OKX Execution Speed

Now that we have an understanding of how both platforms operate, let’s compare their execution speeds in a tabulated format:

| Platform | Execution Speed (milliseconds) | Features |

|---|---|---|

| HIBT | 50ms | Tiered services based on trader volume |

| OKX | 20ms | Global server network for minimal latency |

The Impact of Execution Speed on Trading Strategies

Execution speed plays a crucial role in trading strategies tailored for the dynamic nature of cryptocurrency markets. Traders looking for high-frequency trading need platforms with low latency, such as OKX. Rapid execution allows traders to capitalize on market movements without missing timely opportunities.

On the contrary, if you’re dealing with bond orders over longer timeframes, HIBT doesn’t lag much, offering competitive speeds that may suffice for many traders. However, as the execution speed gap continues to widen, platforms like OKX may prove more advantageous for those focused on immediate returns.

The Vietnamese Market and Its Role in Execution Speed Preferences

The Vietnamese market has solidified itself as a growing sector for cryptocurrency adoption. Recognizing the need for fast and reliable trading execution, many Vietnamese traders are flocking to platforms that prioritize efficiency. Reports show that the increase in crypto users in Vietnam stands at an impressive 125% year-on-year.

This rise in users is leading to new challenges for platforms, including the necessity of maintaining high-speed execution rates amidst the influx of new traders. Speed will likely remain a decisive factor in platform choice as more Vietnamese traders engage with cryptocurrencies.

Future of Bond Orders in Vietnam

As the popularity of digital assets continues to rise, the demand for seamless trading experiences will also grow. Platforms like HIBT and OKX that can innovate in terms of execution technology will likely capture a larger share of the market.

Utilizing advanced technologies, such as machine learning and artificial intelligence, to forecast market trends and enhance execution speeds could potentially reshape trader experiences in Vietnam.

Conclusion: Choosing the Right Platform

In conclusion, when comparing HIBT and OKX in terms of bond order execution speed, OKX clearly has the edge with a faster execution time of 20 milliseconds compared to HIBT’s 50 milliseconds. However, both platforms offer unique features that cater to different trader needs. Understanding execution speed along with other factors like platform features and user interface will be critical as traders navigate the blazing fast world of cryptocurrency.

For those immersed in cryptocurrency trading or blockchain technology, it’s essential to stay informed about the upcoming innovations in execution speeds, especially pertaining to the flourishing Vietnamese market. As you consider your trading strategy, remember that execution speed could make the difference between profit and loss.

Stay tuned to officialcryptonews, where we continue exploring the latest trends in the cryptocurrency landscape.