Bitcoin Price Technical Analysis Using Ichimoku: Insights for 2025

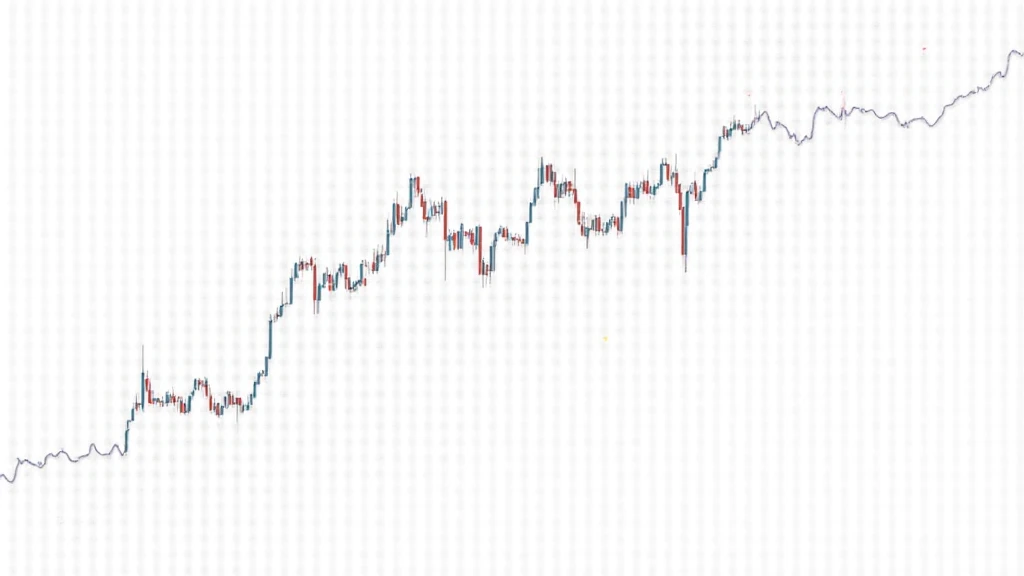

As of 2024, cryptocurrency markets have seen both staggering gains and painful losses, with a notable $4.1 billion lost to DeFi hacks. This volatility underlines the necessity of robust trading strategies that can safeguard investments and maximize returns. This article focuses on Bitcoin price technical analysis using Ichimoku, aiming to equip crypto traders with tools to navigate the dynamic market landscape.

特别地,越南的加密用户增长率目前已经达到了tiêu chuẩn an ninh blockchain。对于渴望在这一快速增长的市场中寻找机遇的投资者而言,掌握技术分析显得尤为重要。

Understanding Ichimoku Cloud: A Brief Overview

Ichimoku Cloud, a technical analysis tool tailored for assessing the Bitcoin price, combines several indicators to provide a comprehensive market view. Originating from Japan, Ichimoku offers insights into market trend direction, momentum, and support/resistance levels. This system stands out because it does not rely solely on past price movements but also incorporates time to gauge future trends. To effectively utilize Ichimoku in trading Bitcoin, understanding its five components is essential:

- Tenkan-sen (Conversion Line): The average price over the last 9 periods.

- Kaiko-sen (Base Line): The average price over the last 26 periods.

- Chikou Span (Lagging Span): The closing price plotted 26 periods back.

- Senko Span A (Leading Span A): The average of the Tenkan-sen and Kaiko-sen projected 26 periods into the future.

- Senko Span B (Leading Span B): The average price over the last 52 periods, also projected 26 periods ahead.

Understanding these components is crucial for formulating effective trading strategies.

How to Read Ichimoku Signals for Bitcoin Trading

Reading Ichimoku signals can be likened to reading a compass; each direction assists traders in making informed decisions. Here are the key signals and their interpretations:

- Buying Signals: When the price moves above the cloud (Senko Span A and B), it indicates a bullish trend. Crossovers where the Tenkan-sen rises above the Kaiko-sen also suggest a buy signal.

- Selling Signals: Conversely, if the price drops below the cloud, it signals a bearish trend. When the Tenkan-sen falls below the Kaiko-sen, this reinforces the sell signal.

- Confirmation: The Chikou Span can confirm these signals. If it is above the price, it adds bullish validation; below the price suggests a bearish confirmation.

Real-World Application: Incorporating Ichimoku indicators can significantly enhance trading decisions. For example, if Bitcoin trades above the cloud, traders can enter long positions, while they might consider short positions if the price trades below. Just like a bank vault protects cash, the Ichimoku framework aims to secure digital assets against erratic market movements.

Real Data Insights: 2025 Bitcoin Projections and Market Behavior

As traders assess Bitcoin price movements, they must consider macroeconomic factors. According to Chainalysis, Bitcoin adoption is projected to increase 20% year-on-year in Vietnam by 2025, driven by growing interest in decentralized finance and blockchain technology. This data not only showcases potential market growth but also signifies a shift in investor sentiment.

| Year | Adoption Rate (%) |

|---|---|

| 2023 | 10% |

| 2024 | 20% |

| 2025 | 40% |

These figures stress the importance of being well-prepared. Smart investors who effectively analyze Bitcoin prices using reliable tools like Ichimoku can stay ahead in the rapidly evolving market.

Case Study: Trading Strategies in Bitcoin Market

Let’s break this down with a case study. Consider the following hypothetical scenario:

As Bitcoin approaches $40,000, traders notice the following Ichimoku signals:

- Price hovering above the cloud indicates a bullish trend.

- Tenkan-sen crossing above Kaiko-sen suggests an upward momentum.

- Chikou Span above the price confirms bullish sentiment.

In this scenario, an experienced trader might take a long position. Simultaneously, they should set a stop-loss just below the cloud to mitigate potential losses. By integrating an analytical approach, traders can significantly influence their outcomes.

Future Challenges: Navigating Bitcoin Volatility

Despite promising signals, it’s crucial to highlight that Bitcoin is not without its challenges. Volatility remains a key concern, with swings that can exceed 10% in a single day. This irregularity necessitates a nuanced strategy, balancing risk while capitalizing on potential gains. Just imagine navigating through a storm; without a sturdy vessel, the chances of capsizing increase dramatically.

Here are some challenges to watch out for:

- Regulatory changes affecting market accessibility.

- Technological vulnerabilities in trading platforms.

- Market manipulation by influential players.

To mitigate these challenges, suggestive steps include firm risk management practices, following regulatory updates, and remaining informed about technological advancements.

Conclusion

In conclusion, Bitcoin price technical analysis using Ichimoku serves as a robust approach for traders seeking to navigate the complexities of the cryptocurrency market. By comprehending Ichimoku indicators and applying them critically, traders can enhance their decision-making processes to achieve favorable outcomes. As the Vietnamese market continues to grow, understanding these analytical tools could provide a competitive edge for investors looking to capitalize on the evolving landscape.

正如“No one said it would be easy”,但通过这些工具,我们可以打开通向加密市场的成功之路。

Stay informed and keep optimizing your trading strategies. For more insights and the latest updates in the crypto space, visit officialcryptonews.

About the Author: Dr. Alex Tran is a financial analyst specializing in cryptocurrency markets. He has published over 15 papers on blockchain technology and has led security audits for various high-profile projects within the industry.