DeFi Lending Platforms in Vietnam: A Growing Trend

With the blockchain industry steadily growing in Vietnam, the rise of decentralized finance (DeFi) lending platforms has caught the attention of many investors and users alike. According to recent statistics, the number of crypto users in Vietnam has increased by over 30% in the past year, indicating a growing interest in cryptocurrencies and DeFi products.

Understanding DeFi Lending Platforms

DeFi lending platforms function like traditional lending institutions but operate in a decentralized manner, eliminating the need for intermediaries. Similar to a bank vault where assets are held securely, these platforms allow users to lend their cryptocurrencies and earn interest or borrow against their assets.

Some popular DeFi platforms include Aave, Compound, and MakerDAO. These platforms offer a range of services that can be beneficial for both lenders and borrowers, particularly in regions like Vietnam where traditional banking services may be limited.

The Benefits of DeFi Lending for Vietnamese Users

- Accessibility: DeFi lending platforms provide financial services to individuals who may not have access to traditional banking systems. With just a smartphone and an internet connection, users can participate in the DeFi space.

- et=”_blank” href=”https://officialcryptonews.com/?p=15592″>Higher Returns: Users can earn higher interest rates compared to traditional savings accounts. DeFi platforms often provide annual percentage yields (APY) that can far exceed what banks offer.

- Security: DeFi platforms utilize smart contracts to facilitate transactions, minimizing the risk of fraud or manipulation. This is crucial for users concerned about security, especially in a rapidly evolving market.

Challenges Faced by DeFi Lending Platforms in Vietnam

Despite the advantages, there are challenges that need to be addressed:

- Regulatory Uncertainty: The Vietnamese government has been cautious about the rise of cryptocurrencies. As of now, there are no clear regulations governing the use of DeFi platforms.

- Lack of Awareness: A significant portion of the population is still unaware of DeFi services, leading to slow adoption rates.

- Volatility: The cryptocurrency market is known for its volatility which can impact users’ savings and investments on DeFi platforms.

The Future of DeFi Lending Platforms in Vietnam

Despite these challenges, the future looks promising. Analysts predict that by 2025, DeFi lending platforms could revolutionize the financial landscape in Vietnam. This may lead to increased financial inclusion, providing people with more opportunities to manage and grow their wealth.

Furthermore, as global interest in DeFi continues to grow, Vietnam stands to benefit from being an active player in this market. The country’s tech-savvy youth, combined with its increasing internet penetration rate, makes it a fertile ground for innovation in the crypto space.

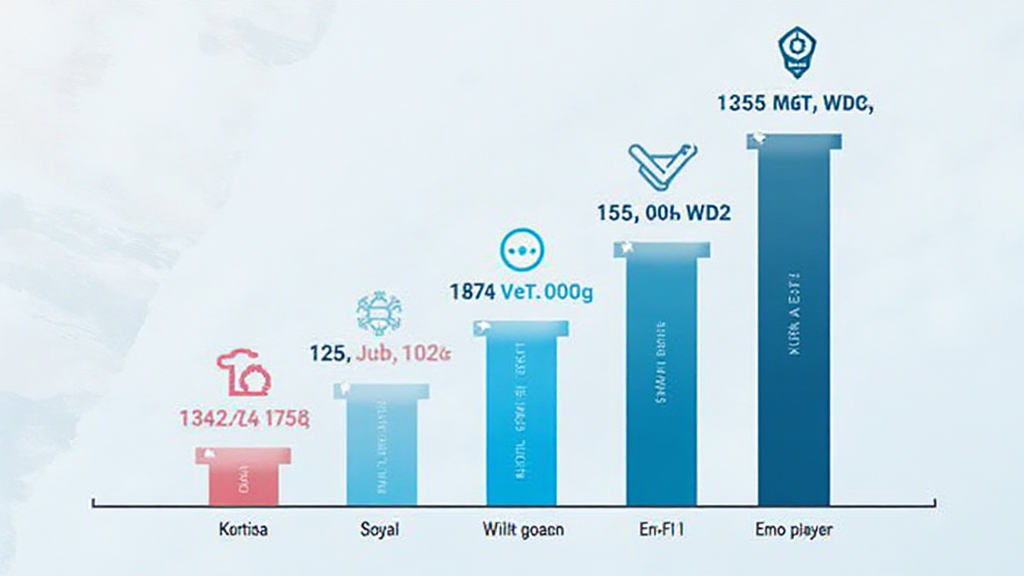

Local Market Insights and Opportunities

According to a report by Statista, Vietnam is one of the fastest-growing crypto markets in Southeast Asia, with approximately 5 million crypto users reported in 2024. This represents a significant opportunity for DeFi lending platforms to tap into a large and growing user base.

- User Growth: The number of Vietnamese crypto users is expected to reach 10 million by 2025, reflecting an increasing acceptance of digital currencies.

- Institutional Interest: Several local banks and financial institutions are exploring partnerships with DeFi platforms, which could enhance legitimacy and boost user confidence.

Conclusion

As DeFi lending platforms continue to gain traction in Vietnam, it is essential for prospective users to understand both the benefits and risks associated. Always consider conducting thorough research and consult with local regulators regarding any financial decisions.

For more information on how DeFi lending can transform your financial strategy in Vietnam, visit ef=’http://hibt.com’>hibt.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice.

Author: Dr. Lisa Tran, a blockchain researcher and consultant with over 15 published papers on DeFi technologies and has led several smart contract audits.