Stablecoins in Vietnam: Understanding Their Impact on the Crypto Market

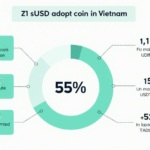

With the increasing popularity of cryptocurrencies worldwide, Vietnam is seeing a dramatic rise in cryptocurrency usage, particularly regarding stablecoins. In 2024, Vietnam recorded a staggering 400% growth in crypto adoption, reflecting a burgeoning interest in decentralized finance (DeFi) and digital assets. This article will delve into the essentials of stablecoins, exploring their significance in Vietnam’s evolving financial ecosystem.

What Are Stablecoins?

Stablecoins are digital currencies designed to maintain a stable value relative to a specified asset—typically a fiat currency like the US dollar. Unlike Bitcoin or Ethereum, which can experience significant volatility, stablecoins aim to offer a more secure option for transactions. They are especially valuable for users looking to navigate the crypto market without the risks associated with traditional cryptocurrencies.

Types of Stablecoins

- Fiat-Collateralized Stablecoins: These are backed 1:1 by traditional fiat currencies, such as USDT (Tether) or USDC (USD Coin).

- Crypto-Collateralized Stablecoins: Backed by other cryptocurrencies, these stablecoins use smart contracts to manage collateral. Examples include DAI.

- Algorithmic Stablecoins: These stablecoins are not backed by any collateral but use algorithms to control the supply of tokens. An example is Ampleforth.

The Role of Stablecoins in Vietnam’s Economy

In Vietnam, stablecoins serve multiple purposes, including providing an alternative store of value, facilitating remittances, and powering smart contracts. As the country pushes toward a digitized economy, the adoption of stablecoins is expected to soar.

Moreover, Vietnam’s government is exploring blockchain technology, implementing policies to encourage innovation within the sector. This initiative hints at a supportive environment for cryptocurrencies and stablecoins, essential for economic development.

Market Potential in 2025

As we approach 2025, stablecoins are anticipated to play a pivotal role in the financial system. With the expected 30% annual growth rate in Vietnam’s crypto market, stablecoins are likely to capture more user attention, especially among traders and investors seeking a safer haven amid the volatility of traditional cryptocurrencies.

The increasing strength of the Vietnamese Dong (VND) in the foreign exchange market could further enhance the appeal of stablecoins pegged to fiat currencies. As such, financial education will be essential for users to understand how to leverage these assets effectively.

Practical Use Cases

Let’s break it down further—consider the following scenarios:

- International Remittances: Vietnamese workers abroad can use stablecoins to send money back home without fearing exchange rate fluctuations.

- E-commerce Payments: Online retailers can integrate stablecoins to reduce transaction costs and speed up payment processing.

- Decentralized Finance: Users can earn interest by lending their stablecoins through various DeFi platforms.

Challenges Facing Stablecoins in Vietnam

Despite their potential, several challenges remain:

- Regulatory Hurdles: The current lack of clear regulations can deter businesses from fully embracing stablecoins.

- Public Awareness: Many users are still unfamiliar with how stablecoins function.

- Security Concerns: Issues related to hacks and volatility in crypto markets may dissuade users.

Conclusion: The Future of Stablecoins in Vietnam

From serving as a bridge for international remittances to the potential facilitation of decentralized finance, stablecoins are transforming the landscape of finance in Vietnam. To ensure a smooth adaptation to these digital assets, it is crucial for the government to establish clear policies and for users to enhance their financial literacy.

As we venture into 2025, the role of stablecoins will likely expand, solidifying their position within Vietnam’s economy. Users and investors should remain informed and proactive in understanding the nuances of stablecoins to harness their full potential in an increasingly digital world.

Not financial advice. Consult local regulators for detailed guidance.

For more insights on cryptocurrency regulation in Vietnam, read our Vietnam crypto tax guide.

About the Author

Dr. Tran Minh, a leading expert in blockchain technology, has published over 20 papers on cryptocurrencies and has led numerous audits for recognized projects in the blockchain domain.