Introduction

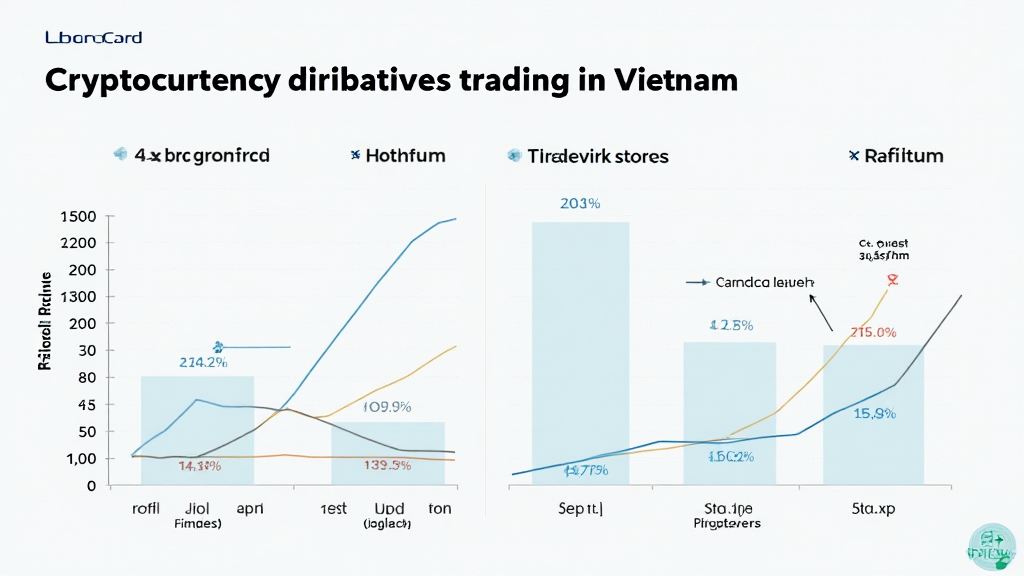

As Vietnam’s cryptocurrency space continues to expand, the rise of cryptocurrency derivatives trading is becoming an increasingly prominent trend. In 2024 alone, it was reported that the total trading volume in Vietnam reached a staggering $80 million, signaling a growing interest in advanced trading options. This outlines the opportunity for traders and investors to capitalize on market fluctuations.

The importance of understanding these trading mechanisms cannot be overstated. This guide aims to provide insights into the possibilities and risks involved in Vietnam cryptocurrency derivatives trading, enhancing your trading experience while adhering to the strict security standards of blockchain, or tiêu chuẩn an ninh blockchain. Let’s dive deeper into this exciting realm.

Understanding Cryptocurrency Derivatives

Cryptocurrency derivatives are financial contracts that derive their value from underlying digital assets. They allow traders to speculate on price movements without needing to own the actual asset. Key types of derivatives include:

- Futures: Contracts obligating the buyer to purchase an asset at a predetermined price at a specified time in the future.

- Options: Offer the buyer the right, but not the obligation, to buy or sell assets at a specified price before a certain date.

- Swaps: Contracts that allow two parties to exchange cash flows or other financial instruments.

Market Dynamics in Vietnam

Vietnam has witnessed a remarkable increase in cryptocurrency adoption, with the user growth rate soaring by over 50% in 2023. Local exchanges and trading platforms are responding to this demand by improving their derivative offerings. One such platform, hibt.com, has been particularly active in innovating trading products.

To illustrate the growth, consider the following table showing the increase in users and trading volume:

| Year | Users | Trading Volume (USD) |

|---|---|---|

| 2021 | 1 million | 10 million |

| 2022 | 3 million | 30 million |

| 2023 | 5 million | 80 million |

The Regulatory Landscape

The Vietnamese government has begun formulating regulations regarding cryptocurrency to tame speculation and protect investors. The recent guidelines emphasize:

- Compliance with anti-money laundering (AML) laws.

- Integrating digital asset trading into existing financial regulations.

- Enhancing consumer protection standards.

Staying informed about regulatory updates is crucial for anyone involved in Vietnam cryptocurrency derivatives trading.

Benefits of Trading Derivatives

Here’s what you can gain by venturing into derivatives trading:

- Leverage: Derivatives allow traders to control larger positions with less capital.

- Hedging: Traders can use derivatives to protect against potential losses in their cryptocurrency portfolios.

- Diverse Strategies: They enable various trading strategies to profit from both rising and falling markets.

Risks and Challenges

However, trading derivatives comes with inherent risks:

- Market Volatility: Cryptocurrency prices can fluctuate dramatically.

- Leverage Risks: While leverage can enhance profits, it can also significantly amplify losses.

- Complexity: Understanding different derivatives and strategies can be overwhelming for beginners.

Conclusion

As Vietnam steps further into the world of cryptocurrency derivatives trading, traders must equip themselves with knowledge and best practices. Familiarizing yourself with market dynamics, regulatory frameworks, and inherent risks is essential for successful trading in this evolving landscape.

Ultimately, embracing this innovative trading method while adhering to security standards, like tiêu chuẩn an ninh blockchain, will empower investors to make informed choices and leverage the expanding Vietnamese market.

For more detailed insights, feel free to explore our other articles such as Vietnam Crypto Tax Guide. Stay ahead in the crypto game with officialcryptonews, your trusted resource for the latest developments in cryptocurrency.